The environmental charity Hubbub has released ‘Reuse Systems Unpacked’, a report that draws on interviews with key industry players and a poll of consumers to understand attitudes toward reusable packaging and pathways to scaling reuse solutions.

While Hubbub acknowledges that there is no ‘silver bullet’, it says that convenience and cost, education and research, and technology and design are key considerations when it comes to establishing reusable packaging systems of scale. The organisation calls on companies, governments, and environmental organisations alike to account for these factors in order to successfully carry reuse systems forward.

What is holding consumers back?

The Hubbub report, which was funded by Bunzl plc and launched by The Royal Society of Arts, includes contributions from 40 organisations in the UK and Ireland, as well as a poll of 3,000 people conducted in April 2022.

According to the poll, 73% of people in the UK think more needs to be done to make it easier to choose reusable alternatives to single-use food and drink packaging.

However, the general public seemed to have some concerns regarding the practicalities of reuse systems. For example, 38% of respondents noted worries that reusable packaging might not be clean or hygienic, with 26% also concerned about scratches, stains, or damage.

During the initial outbreak of the COVID-19 pandemic, there were concerns that the coronavirus could be transmitted via surfaces, placing reusable packaging, which is intended for multiple cycles of use, often by multiple different people, under scrutiny. While public health bodies have demonstrated that COVID-19 is airborne, with a very low risk of surface transmission, Hubbub’s research suggests that worries over hygiene and reusable packaging remain – despite also the rigorous cleaning processes that reusable packaging is subject to, as noted by John Hocevar, oceans campaign director at Greenpeace USA.

The survey also found that, while 67% of respondents said they would be open to borrowing and returning a reusable container for groceries, 27% would be discouraged by the fact that they may have to carry or store reusable packaging until they can return it. 26% were also worried that they might forget to return the container, according to the research.

Another concern flagged by respondents is that reusable packaging solutions may cost more money. 31% of respondents suggested this was a factor that could put them off engaging with reusable packaging systems.

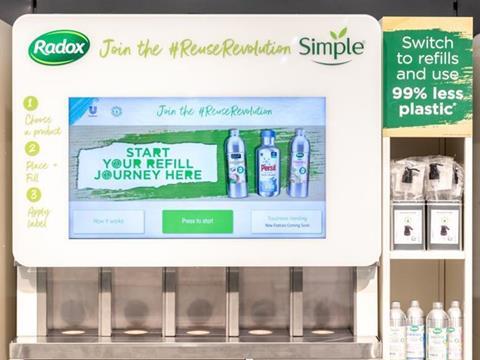

At the moment, many reuse schemes – such as Starbucks’ returnable cup scheme or the Re refill system used by retailers including ASDA, Co-Op, and Tesco – rely on a deposit that is repaid to consumers when the packaging is returned. However, this is often in the form of credit or discounts that can only be applied to the same retailer or brand, which may skew consumers’ perceptions as to the cost-effectiveness of reusable packaging compared to single-use alternatives. Additionally, with the Hubbub report finding that consumers are concerned about remembering to return reusable packaging, the fact that deposits are only redeemable when the packaging is returned may lead consumers to view reuse as a potential financial risk or loss.

Convenience and cost are key

As Hubbub points out, single-use packaging is incredibly convenient, and infrastructure – from initial purchase through to waste collection and recycling – is already well-established to process it. If reusable packaging is going to become a viable option for consumers, Hubbub says that it must get close to the same level of convenience, with minimal friction and systems that fit with current patterns of behaviour.

This is supported by previous research from RECOUP, which found that 56% of consumers either wouldn’t travel or would only travel under a mile to empty their containers for recycling and claim their deposit back. However, it is worth noting that this survey was conducted in 2018; a number of reuse trials have been launched since then, including from high-profile brands like McDonald’s, which may have changed some attitudes toward the extent of the travel burden associated with reuse.

In Hubbub’s research sample, 32% of consumers said they would be more willing to use reuse systems if they did not have to go out of their way to do so. This implies that travel remains a concern, but also points to the potential of integrating reuse solutions into existing behavioural patterns, such as buying coffee-to-go, and thus building reuse into routine.

Hubbub emphasises beverage cups as a particular target for achieving convenient reuse systems at scale. The organisation’s research found that 64% of people would be open to borrowing and returning a reusable cup for a drink, with respondents saying that they would be most likely to do so while visiting a café they go to regularly. As such, Hubbub points to schemes including Costa’s BURT (Borrow, Use, Reuse, Take back) trail in Glasgow and Starbucks’ returnable cup pilot in London, as good practice opportunities to demonstrate how reuse can be embedded in existing consumer experiences to maximise convenience.

Hubbub also explains the importance of collaboration in enhancing convenience. Through collaboration, Hubbub says that brands and retailers could boost the accessibility and inclusivity of reusable packaging by offering more return points across multiple locations. 34% of people polled by Hubbub agreed that wide availability of schemes in their local area would be an important factor for them.

The organisation adds that there is also an opportunity for companies to reduce costs by collaborating on collect-from-home and reverse logistics networks, which would have the additional benefit of improving consumer convenience. While this may present a barrier at the brand level, as packaging standardisation reduces opportunities for design elements like logos, Hubbub suggests that branding could be structured around the reuse system itself for a three-dimensional experience that further engages consumers with the concept of reuse.

Under the umbrella of convenience, there are also cost considerations. Hubbub’s polling found that reusable packaging being offered at no extra cost was the key motivator for consumers, with the caveat that consumers seem willing to pay more or less depending on different reusable packaging types and factors like premium design. Overall, however, 41% of respondents said that the elimination of extra costs would help them to get on board with reuse solutions.

The organisation says that incentives are an important part of drawing in consumers while also driving returns, upon which reuse systems rely. 38% of those polled said that earning rewards or discounts could be a motivating factor for engaging with reusable packaging.

Hubbub notes that deposits are not always the most effective solution as the higher upfront cost can dissuade consumers and push them towards cheaper, one-off purchases. As an alternative, the organisation says that companies could look at only charging for unreturned packaging following a certain period of time after purchase, but this penalisation may put consumers off using reuse schemes again if they lose money. Such a solution would simply shift where in the reuse cycle consumers are required to cover additional costs, and also relies on supporting technologies like an app or online account that could be another friction point for consumers.

In the case of supermarkets, Hubbub says that subscription models could offer a simpler and cheaper solution for frequent or large-volume purchases. With the rise of online shopping during the COVID-19 pandemic, many consumers already have online accounts with retailers that could be used to offer a reuse system. 32% of people said they would be willing to use reusable packaging for home delivery, according to Hubbub, which could provide a boost for trials such as the Refill Coalition’s plan to include a refill option for bulk home deliveries from retailers like Waitrose, Morrisons, and M&S. Similarly, Tesco’s partnership with Loop, which Hubbub highlights in the report, is linked with the existing Clubcard rewards scheme to incentivise consumers with a familiar interface.

Research and education opportunities

Hubbub acknowledges that reusable packaging is typically more resource-intensive to produce and transport compared to single-use, as it can require extra material weight and durability. This means that reuse systems rely on high return rates to establish a lower environmental impact over time. While Hubbub says that there are proven environmental benefits of reuse, it is difficult to account for the disparity between reuse systems in lifecycle analyses (LCAs), often giving variable break-even points for reuse compared to single-use alternatives.

This was demonstrated by a recent report from FEFCO, which drew on an LCA from Ramboll and VTT to compare single-use paper packaging with multiple-use plastic packaging. As with similar research, the report suggests that both single-use and reusable packaging have production requirements and value chain hot-spots that point to a higher environmental burden with some trade-offs to be expected. As such, FEFCO says that the decision between single-use and reusable packaging must be made on a case-by-case basis, and Hubbub likewise says there is no ‘silver bullet’ approach for reuse.

Hubbub says that transparency is important for conducting reliable and comprehensive LCAs for reusable packaging, adding that establishing industry standards for LCAs will help to provide credible and accurate data. While packaging return rates will vary depending on the shelf-life and application of the product, Hubbub believes that a consistent approach to LCAs will help to set industry targets for return rates, develop more convenient reuse solutions over time, and establish effective incentives.

Technology could play a role here in helping to visualise how consumers engage with reuse systems, as well as enabling businesses to monitor stock levels and return rates. However, Hubbub cautions against “over-engineering the solution” and alienating some consumers. The organisation says that older demographics may be less familiar with technologies like QR codes and smartphone apps and that a tech-free alternative should be offered in tandem with digital reuse systems to improve accessibility.

This leads to the need to further educate consumers on reuse systems. 38% of Hubbub’s respondents said that knowing reuse is better for the environment would encourage them to engage with reuse systems. As such, more reliable LCA data that actually demonstrates the benefits of reuse could act as an incentive for consumers in itself.

In addition, with hygiene being perceived as a barrier to reuse by consumers, Hubbub says that clear and simple communication explaining how the system works, including the washing process, could provide reassurance.

Interestingly, the organisation notes that very few of the organisations it spoke to reported that customers were raising hygiene as a concern, which is slightly contradictory to the polling data. This could mean a balance is needed when communicating to consumers so as not to draw too much attention to hygiene and create false perceptions of the risk involved with reuse.

The use of packaging materials that do not smudge or stain could help to subtly boost consumer perceptions of the hygiene of reusable systems, according to the organisation. Hubbub suggests that packaging design should focus on balancing aesthetic with the functional requirements of reuse, noting that consumers may actually be more likely to return packaging that is less attractive as there is less desire to hold on to it.

Taking reuse models forward

Discussing the importance of the report, Alex Robinson, CEO of Hubbub, says: “To effectively tackle the issue of packaging waste, reuse must become mainstream. For this to happen, it’s crucial that companies across the food & drink industry, along with policymakers, work together and learn from each other.

“It’s clear the public are hungry for change. We hope this report helps to accelerate progress across the food and drink industry and drives us quickly towards a society where reusable food and drink packaging is the norm.”

James Pitcher, head of sustainability at Bunzl plc, adds: “We have been using our scale and unique position at the centre of the supply chain to work with our customers and suppliers to lead the industry towards a more sustainable approach to packaging.

“To move away from a linear mindset to a more circular one we need to understand the opportunities and challenges involved, which is why we’re pleased to have supported this work.

“The circular economy has to go mass market to be effective and research like this means we’ll understand what’s collectively required to reach a macro-solution sooner.”

As part of the report, Hubbub spoke to organisations including DEFRA, WRAP, and Zero Waste Scotland to understand the potential role of policy and regulation in encouraging the more widespread adoption of reusable packaging systems. These conversations reportedly lead Hubbub to identify Extended Producer Responsibility (EPR) schemes, adding charges for single-use packaging, and removing VAT from deposit payments as potential policy points that could help to incentivise and scale reuse.

Hubbub also calls for further funding for pilot schemes and early adopters of reuse systems from governments and organisations in order to accelerate the future growth of these solutions.

Going forward, Hubbub says that companies should account for convenience and cost when establishing and developing reuse systems, with success being most likely where schemes do not require significant changes in behaviour and make the most of consumer attitudes toward sustainability. Additionally, standardised research and education can help to engage both the industry and consumers, while technology and design can supplement these factors for further engagement and accessibility.

Hubbub concludes that these considerations are both barriers and opportunities, pointing to where in the value chain intervention can facilitate reuse systems at scale.

No comments yet