.gif)

Packaging Europe has collated views from across the value chain on the current challenges and wider implications of the COVID-19 pandemic for packaging and FMCG. Answers flooded in from across Europe which shed light on the mindset and direction that the industry is taking as a whole.

The survey findings reflect a cross section of the supply chain with responses from machinery producers (12%), brand owners (13%), packaging producers/converters (33%), materials and additives producers (11%), retailers (5%), and a variety of representatives from designers, consultants, and waste management companies etc (26%).

Shifts in production

One of the main challenges for the industry has been a change towards a work-from-home policy, due to numerous lockdowns and restrictions implemented by governments across Europe. We asked: Have your corporate offices introduced a work-from-home policy? And a resounding 85% of companies responded ‘Yes’.

We also wanted to discover roughly what percentage of employees have taken time off work because of infection or suspected infection so far. 39% responded at 1-10% and an encouraging 25% answered zero. Only 13% of responses recorded over 50%.

To maintain productivity, an impressive 87% of respondents claimed they were adapting shifts to maintain social distancing to sustain productivity in their factories, whereas 22% answered they had increased reliance on automation. It is clear to see the majority of the packaging industry takes the health and safety of its employees seriously.

Operational challenges

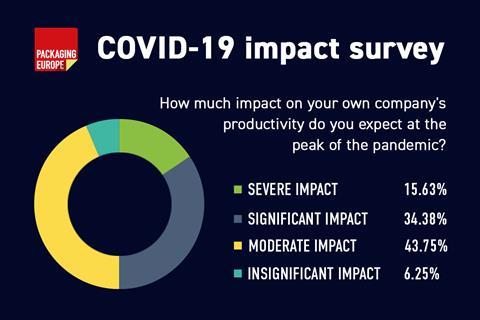

With a particular focus on the peak of the pandemic, we were interested to know how much impact packaging companies expected on their own productivity. Merely 6% believed it would cause an ‘insignificant impact’, with the majority of 44% expecting a ‘moderate impact’. Rising into more startling opinions, 16% expect a ‘severe impact’, and a troublingly 34% believe they will be ‘significantly impacted.’

There will be an expected number of challenges to keep the FMCG supply chains running smoothly, from keeping production plants fully operational, to disruptions across supplies and logistics. When prompted to rate these challenges, 79% expected a ‘moderate to significant’ challenge to keeping production plants fully operational. 69% also expected a ‘moderate to significant’ challenge in disruption to supplies to their factory, and a majority of 71% anticipated a similar degree of disruption to logistics.

These findings suggest an overall cautious industry expecting significant challenges in the coming months ahead.

.jpg)

We were also keen to uncover how well the packaging industry thinks their national government is responding to the pandemic, in terms of handling the crisis and providing support to the packaging value chain. The largest response came in as ‘adequately’ with exactly half of respondents choosing this answer. 26% responded ‘very well’, whereas an alarming 24% believed their national government was ‘not doing enough’.

Long-term impacts

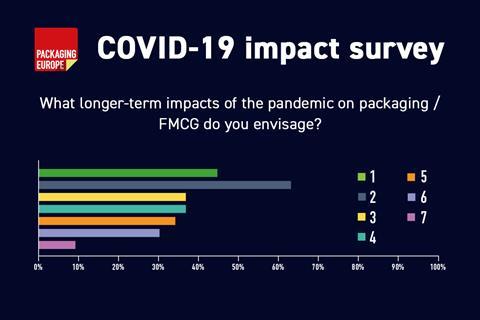

Lastly, we wanted to find out what the respondents envisaged the longer-term impacts the pandemic would have on packaging/FMCG.

Interestingly, 63% believe it will accelerate the e-commerce trend. Over a third believe there will also be a shift in consumer preference around packaging materials/formats and a reduction in consumer enthusiasm for refill/reuse packaging systems. 34% have an eye on supply chain traceability, expecting more demand from consumers, and 30% believe there will be a shift towards increased investment for automation.

Promisingly, just under half of all respondents (45%) believe there will be a greater societal appreciation of the positive role of packaging.