According to CEFLEX, a truly circular economy must be demand-driven. The organisation has worked backwards along the supply chain to clarify the scale of mechanical and chemical recycling, sorting, infrastructure, and collection needed to ensure demand for recycled materials as they re-enter the economy, expressing support for the Ellen MacArthur Foundation’s call for a EUR 2 billion investment to increase recycling capacity fourfold by 2025.

A demand-driven model for circular flexible packaging

Bringing together over 180 European companies, the CEFLEX initiative is working towards the goal of making all flexible packaging in Europe circular by establishing collection, sorting, and recycling infrastructure. By 2025, CEFLEX is aiming for the collection of all flexible packaging and for over 80% of the recycled materials derived from post-consumer flexible packaging to be channelled into valuable new markets and applications, substituting virgin materials.

Last year, in a position statement, CEFLEX set out a five-step roadmap intended to accelerate the introduction of a circular economy for flexible packaging. The main theme bringing together this roadmap is collection. The group considers it essential to collect all flexible packaging, including on-the-go packaging, through a separate stream (or with other light packaging). The group also acknowledges that additional sorting of flexible packaging from mixed waste will likely be needed to fully access post-consumer flexible packaging materials for recycling.

The latest proposal from CEFLEX, also deemed an essential part of reaching its goals, is the demand-driven circular economy model.

This follows a recent report from the Ellen MacArthur Foundation, which – alongside emphasising that elimination should be the first port of call when addressing the challenge of single-use flexible packaging, followed by upstream design innovation – suggests that an investment of at least EUR 2 billion is needed to achieve a fourfold increase in recycling capacity by 2025.

CEFLEX says that it supports this call for investment. The group adds that this fourfold increase would involve doubling the mechanical recycling capacity of PE film to 3 Mtpa, while developing a recycling stream for PP film with more than twice today’s capacity for PP and PO. As for chemical recycling, an additional equivalent 3Mtpa capacity is needed, according to CEFLEX.

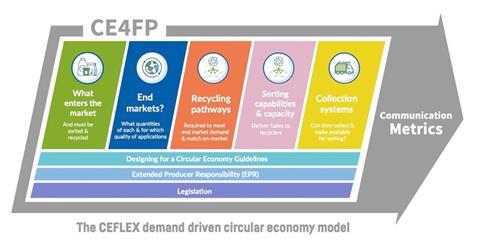

As part of its demand-driven model, CEFLEX identifies five action areas across the value chain: what enters the market, end markets, recycling pathways, sorting capabilities and capacity, and collection systems.

The model works backwards, starting with what enters the market as recycled flexible material. CEFLEX says that this must be sorted and recycled itself in the future, to ensure a fully circular model.

The step before this is end markets, the stage that addresses what quantities and qualities of recycled material are needed for different applications. This is influenced by recycling pathways, the next step, which determines what types of recycled material can be produced to match market demand.

Next is sorting capabilities and capacity, which are required to deliver bales to recyclers. The last step in a backwards demand-driven model is collection. This is also the step that enables all others, echoing CEFLEX’s earlier emphasis that collection is key to meeting its targets by ensuring waste materials are made available for sorting, delivered to recyclers, and recycled in turn.

Overall, CEFLEX says that the key to making the “fundamental switch” from a linear to a circular economy is enhancing end market pull and making recycled flexibles as financially competitive as possible against virgin equivalents. The group says that it has identified potential end markets for an additional 1 to 2 million tonnes per annum of post-consumer mechanically recycled materials from flexible packaging. This would include tapping into the value of recycled PE and PP flexible packaging.

This could be a significant boost in meeting the Circular Plastic Alliance’s (CPA) ambition to achieve at least 10 million tonnes of recycled plastic in products and packaging placed on the European annually by 2025, CEFLEX adds. At present, CPA estimates that only 5.2 million tonnes of plastic recyclates are produced annually in the EU.

Multiple approaches

Alongside these steps, CEFLEX also highlights the importance of its Designing for a Circular Economy (D4ACE) Guidelines, which are aimed at helping the flexible packaging value chain to ensure packaging is designed to be recyclable from the very beginning of its lifecycle and to harmonise collection, sorting, and recycling processes. The D4ACE Guidelines provide advice on design considerations including materials used, barrier layers and coatings, size, shape, inks, and adhesives.

There are two aspects to designing for a circular economy, according to CEFLEX. The core design requirement involves product protection, usage, information, and marketing. These account for aspects of design such as end application; for example, flexibles are often used to package food, and barrier and other protective properties cannot be compromised in these cases. In addition, this requirement encompasses clear communication on how flexible packaging should be recycled in different settings and helps to verify claims to recyclability made by companies.

The end-of-life design requirement covers collection, sortability, and recyclability. CEFLEX has identified a hierarchy of preference for recycling streams, starting with mono-material PE and PP, followed by polyolefin mixes and then, finally, all mixed plastics. In 2020, CEFLEX stated that it strongly recommends the use of flexible packaging made from recyclable mono-material. CEFLEX also says that flexible packaging should not be mixed with paper, board, or glass, in order to maximise recycling quality.

Earlier this year, CEFLEX was awarded UK Research and Innovation (UKRI) funding to develop and update its DF4ACE Guidelines. This apparently means that an extensive testing programme will now be undertaken, bringing together laboratories, universities, and industry experts in an attempt to deepen the understanding of how specific design elements impact sorting and recycling.

In addition, CEFLEX claims that its Quality Recycling Process (QRP) will be key to developing a demand-driven circular economy. CEFLEX adds that, in semi-industrial trials, its QRP demonstrated improved quality and higher value end market applications for recycled flexible packaging materials. This reportedly includes recyclate that could replace virgin polymer grades for demanding film and flexible packaging applications without compromising on quality.

CEFLEX is currently developing a next-generation waste processing plant based on its QRP, with a commercial launch scheduled for 2023. The “modular and responsive sorting and recycling approach” will reportedly enable “a much greater percentage of flexible packaging to be returned to the economy – and in the quantities and the qualities needed to meet the requirements of new end markets”.

Graham Houlder, project coordinator at CEFLEX, told Packaging Europe: “CELEX believes that having such a plant would also send a powerful economic current across the sector and incentivise greater collection for recycling of flexible packaging, providing even more recycled materials in the range of qualities different end markets demand.”

Legislative intervention and producer progress

Within a demand-driven circular economy model, CEFLEX expresses support for Extended Producer Responsibility (EPR), as it has done previously. For example, in its five-step roadmap to enhance the collection of flexibles, CEFLEX says that its stakeholders intend to work with national authorities to help deliver effective EPR schemes with flexible packaging included.

The implementation of EPR tends to vary between countries and even regions. In some cases, the inclusion of flexible packaging is not clear. The UK’s EPR scheme, as an example, will work with WRAP to ensure the recyclability of packaging is clearly labelled by March 2026, but plastic films and flexibles seem to be excluded from this requirement. This suggests that challenges remain in implementing EPR schemes that incorporate flexible plastics.

Producers themselves are also making pledges to improve the recyclability of flexible packaging. Dow concurs with CEFLEX regarding the need to incentivise the adoption of collection, sorting, and recycling for flexibles.

Romain Cazenave, packaging EMEA marketing director at Dow, comments: “We’re working with CEFLEX and other organisations to make sure that everybody adopts the same development rules so that flexible packaging waste becomes an attractive material and there are more incentives to sort and recycle it.

“The better you can monitor the quality of the waste, the less challenging it is to recycle. We are aiming to reduce the spectrum of our waste to make it more valuable.”

In March, major brand owners Mars, Mondelēz International, Nestlé, PepsiCo, and Unilever committed to increasing investment with the intention of accelerating the transition to a circular economy for flexible packaging across Europe. Working with governmental bodies and value chain partners, the companies will apparently focus on putting forward concrete proposals to enable collection, improve sorting, and innovate in the area of recycling for flexible plastics. Each company says it will also review packaging design, aiming to reduce materials, improve recyclability, and incorporate more recycled and renewable content.

Gloria Gabellini, director of packaging policy at PepsiCo, explains: “To ensure flexible packaging is kept within the economy, we will need improvements to the waste management infrastructure, which must be supported by the right policy instruments.”

No comments yet