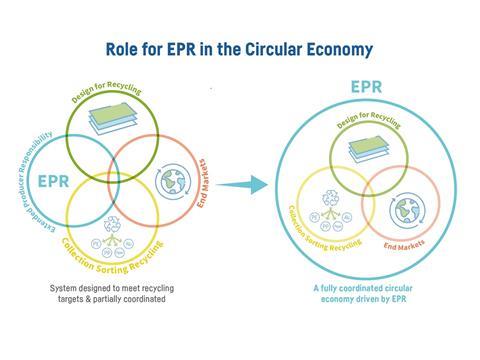

Across Europe, Extended Producer Responsibility (EPR) schemes facilitate the collection, sorting and recycling of consumer (flexible) packaging. A new set of criteria are helping support these schemes address a challenging packaging format and be designed to achieve material circularity.

The EU is aiming to recycle 55% of its plastic packaging by 2030, but many industry players doubt this can happen without Europe’s diverse EPR schemes also embracing a more inclusive and circular approach to flexible packaging.

“EPR is at the centre of everything,” said Mike Jefferson, a consultant to the Circular Economy for Flexible Packaging (CEFLEX) project, a collaboration of over 180 European companies, associations and organisations representing the entire value chain. “For example, it’s important that EPR schemes have control on the recyclate specifications coming out of a sorting centre so in a large European country there are not a hundred centres producing a slightly different output.”

Jefferson does acknowledge that the design of EPR schemes varies across Europe, which means they each need tailored solutions for their markets, but he reiterates that there are still certain principles that would push each country in the right direction and collectively enhance circular collection, sorting, recycling and design.

“The EPR Criteria for Circularity (C4C) was something that CEFLEX developed along with its stakeholders, including a number of major brands” Mike said during a webinar hosted by Packaging Europe in May 2022, adding that they were designed to encourage the needed actions and investment all along the supply chain.

The criteria cover best practices in operations, financing, governance and communication, all of which are underpinned by the principle of full material circularity, which it defines as “All materials captured, recycled and used in a wide range of sustainable end markets – independent of their full net cost and recycling targets”.

This focus on end market demand and applications is, argue CEFLEX, at the heart of the switch from optimised linear approaches to delivering a truly circular system. Infrastructure and systems delivering a far greater amount of recycled content to replace virgin materials, matched to a wide range of existing and new applications needs to take shape. EPR schemes are central to this, and can help manage the material flows into sorting and recycling systems are matched with end market demand.

Road tested with frontrunners leading the change

They were finetuned with feedback from EPR schemes themselves, including Amanda Fuso Nerini, head of international affairs at CONAI, an Italian non-profit EPR consortium of over 750,000 businesses that produce and use packaging. Fuso Nerini endorsed the CEFLEX criteria for circularity as a sound basis for all packaging and said similar principles in Italy already implemented by country’s EPR schemes that collect all flexible packaging, from commercial to household waste.

“It is a big investment to allow the collection, sorting and recycling of all flexible packaging,” she said, adding that Italy committed to these circular investments in part because of her country adopting similar C4C principles. “It involved a framework agreement that defined the quality specification and all the criteria or requirements that have to be achieved by local authorities.”

Jens Nießmann, Managing Director of Reclay, a German based group of compliance schemes in several countries, said his country’s EPR schemes are also “fully in line” with C4C in terms of collection, but if more of the country’s EPR schemes embraced all elements of the criteria then it could create the needed circular ripple effects further up the value chain.

“We have ten to eleven competing [EPR] schemes and it’s probably fair to say competition is mostly driven by providing the lowest cost for compliance,” Nießmann said, explaining that the infrastructure under each scheme differs, which affects the quality of sorting and recycling in particular. “Our clients are producers, brand owners and retailers, and they ask for the lowest price given that legal insurance is there – it is not about providing the highest recycling quotas. Price will remain the predominant criteria, however, with mandatory recycled content quotas at the horizon, more and more brand owners will pay attention to the availability of recycled feedstock.”

Standardization, governance and communication

Designing and funding more circular EPR schemes is critical for more recycled flexible packaging because it offers stronger market incentives, according to Jochen Hertlein, packaging sustainability lead at Nestlé, a CEFLEX stakeholder.

“Schemes should adopt common criteria based on shared industry good practice to minimise a fragmented approach to packaging in different countries. To this end, we would not design packaging for France and then have an entirely different packaging concept for Italy and so on,” he said, adding that the current linear economy approach to packaging is one the main barriers to increasing recycling in practice.

Mr Hertlein went on to explain that the more EPR schemes share a common understanding of circularity goals, the more likely it is that brands will have increase the share of circular designed products. However, he added that the selection of packaging materials and concepts per product and country must be directed by where the greatest demand exists for recycled materials and which applications are the most profitable to run the EPR schemes.

“If we want to make sure that the EPR systems in the different markets work effectively and efficiently, we need to engage with them much more than we do today,” Hertlein added.

Joachim Quoden, Managing Director of the Extended Producer Responsibility Alliance (EXPRA), a non-profit group of 30 packaging and waste recovery and recycling systems from 28 countries, said a critical aspect to aligning EPR schemes around circularity criteria is through stronger governance.

“With recycling targets of 55% in 2030, and its new measurement point, we will have to collect 80-90% of all packaging put on the market,” Quoden said, but warned that several member states have failed to transpose the EU’s 2018 Packaging and Packaging Waste Directive into national law, which legally requires at least 70% of all packaging waste to be recycled. “If you have neither a reliable legal basis nor an enforcement, how can we expect investments.”

The most effective EPR schemes are those operating under a clear national legal framework, says Quoden, who believes the biggest wins have also been supported by strong communication to stakeholders – because they generate buy-in from the consumer up to big industry players.

CONAI’s Fuso Nerini agreed that both effective governance and communication are critical pieces of the EPR circularity puzzle and recommended national campaigns help consumers to support more profitable recycling, such as better sorting at the source.

“We are working a lot with schools,” she said, adding that Italy focused on digital campaigns which helped increase the sorting and recycling rates of carrier bags for example. “This will help collection, but also the technologies like digital marking to better read packaging and separate waste into certain streams.”

The utilisation of these immediate actions also plays an important role in overcoming another longer term challenge – time. The clock is ticking to invest and implement the needed circular economy infrastructure to reach EU recycled packaging targets, but many companies remain slow to act as they wait for the entire supply chain to move.

“It’s not easy for industry just to suddenly switch to new technologies, it needs planning and that needs time,” Mike said, arguing that the Criteria for Circularity is a a constructive and practical check list for EPR schemes and stakeholders to work through on their journey to making packaging waste materials circular – and a promising basis to incentivize the entire supply chain to move forward together.

No comments yet