A new report from McKinsey has examined the attitudes of international consumers towards sustainable packaging – identifying varieties in hygiene concerns, environmental priorities, and the definition of a ‘sustainable’ material – and lays out five key questions for policymakers to answer when developing future strategies.

A survey was carried out with over 11,500 consumers across eleven countries to build upon previous studies into US-based and global consumers’ perspectives on sustainable packaging. It is said to cover a ‘statistically significant’ sample size across 66% of global GDP, 50% of the global population, and various demographics within each country.

Post-pandemic approaches

Since the height of the COVID-19 pandemic, the intense consumer focus on hygiene seems to be dwindling. The report suggests that the sharp rise in single-use packaging in response to fears of contamination and food safety is easing off, although it adds that such considerations are still more present in consumers’ minds than they were before the pandemic began.

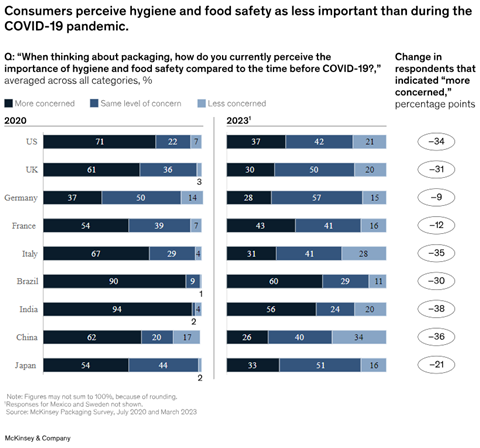

Consumers from each sample country were asked to evaluate whether they were more, less, or equally concerned about hygiene and food safety compared to their pre-COVID attitudes. Results from 2020 and 2023 were then compared to gauge potential shifts.

Amongst the most drastic shifts in percentage points of those more concerned are India at -38, China at -26, and Italy at -35, indicating that general attitudes in these countries are starting to relax. Conversely, German consumers have undergone a shift of only -9 percentage points, French consumers -12, and Japanese consumers -21 – it is worth noting, however, that these countries reported fewer ‘more concerned’ and more ‘same level’ or ‘less concerned’ attitudes in 2020 than the highest scorers did.

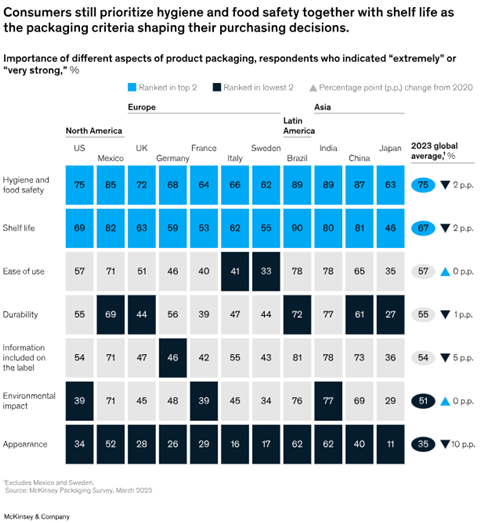

While COVID-specific fears are decreasing, general hygiene and food safety appear to remain prominent in consumers’ minds. When asked which aspects of product packaging they viewed with ‘extreme’ or ‘very strong’ importance, these details ranked amongst the top two in every country, as did shelf life.

Consideration of price has also risen amongst all consumers by 11% since 2020, McKinsey continues. Developed nations like Germany, Italy, France, Sweden, the UK, Japan, and the US are reported to have seen double-digit increases, whereas developing nations’ statistics have risen by low or mid-single-digit percentages.

Even so, the report suggests that some consumers would pay higher prices if the packaging they bought were environmentally friendly – especially where fresh products, fruits, meat, or poultry are concerned. Individuals on a higher income would apparently be more inclined to buy a product claiming its packaging is sustainable than the same product in a less sustainable alternative. Respondents living in developing nations also reported that they would be more inclined to pay extra than those in developed countries.

Planetary impacts

In what many consider to be a post-COVID world, the temporary suspension of sustainability concerns in favour of sanitation is lifting rapidly. The packaging industry is once again pushing for new materials and packaging formats to meet their own and external sustainability targets, upcoming legislation and regulations, the expectations of environmentalist organisations and consumers, and more.

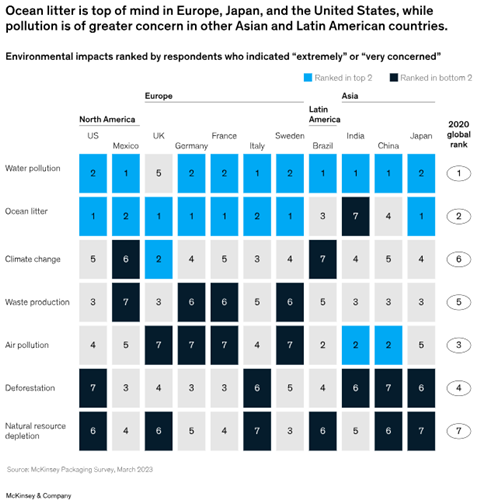

One of the main trends to emerge is consumer discomfort around the impact of packaging waste. As part of the report, McKinsey asked respondents which threats to sustainability they were “extremely” or “very concerned” about; broadly speaking, water pollution arose as one of the top two factors in every participating country except the UK, where climate change took the second spot.

Ocean litter only ranked below the top two amongst Brazilian, Indian, and Chinese consumers. They instead expressed their reservations around air pollution – which, alongside waste production, proved to be a lesser concern in Germany, France, and Sweden.

On the other hand, a general consensus was reached amongst American, British, Italian, Brazilian, Chinese, and Japanese consumers that natural resource depletion was not an extreme concern. Deforestation also ranked lowly in the US, Italy, India, China, and Japan.

Differing opinions between nations appear to be influenced by the circumstances in each country – its natural geography and climate, potentially its economic status, and the environmental impacts most relevant to each location. While the rising interest in consistent international legislation means that extreme variety in sustainability metrics from nation to nation could eventually phase out, this is not yet prevalent enough to create a united consumer viewpoint.

McKinsey proposes that, in Europe, consumers could lean towards more sustainable packaging options if product labelling were to be improved, or rebate or incentive programmes were introduced. Other regions could benefit from increased availability of sustainable products and more accessible pricing, it suggests.

As such, it is advised that companies “can continue to pursue a nuanced approach, remaining flexible about the sustainability levers deployed within each country”.

Defining sustainability

A similar outcome emerges in consumers’ perceptions of what a sustainable packaging material even looks like.

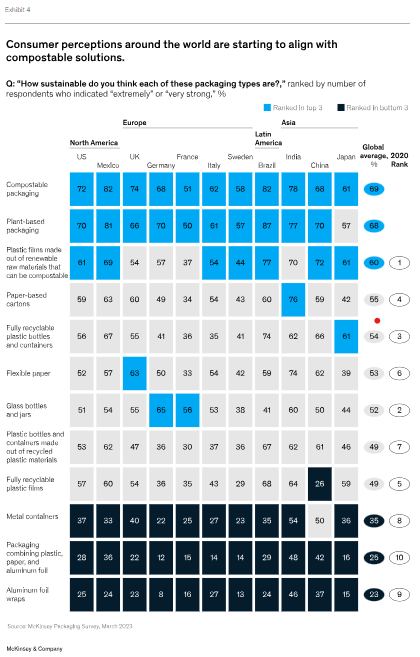

Compostable and plant-based packaging took a significant lead in every country except Japan, where fully recyclable plastics or those containing recycled content were considered to be similarly sustainable. Plastic films made from renewable or compostable materials were also highly regarded across the board.

On average, paper-based cartons also scored highly, coming in the top three amongst Indian consumers. Less enthusiasm was shown to flexible paper, which came third in the UK’s rankings but was relatively central everywhere else.

Fully recyclable plastics did not generate large amounts of interest, either. Containers made of recyclable plastics are noticeably more popular in Asia and Latin America than North America or Europe, while Chinese consumers considered recyclable films to be the least sustainable packaging type amongst the available options. Every other country was united in placing aluminium foil wraps, metal containers, and multi-material packaging containing plastic, paper, and aluminium foil at the bottom of their lists.

American, British, and Japanese consumers appear to consider metal packaging significantly more sustainable than the other options, and Mexico was the only country not to rank it as the most sustainable option of the three. On the other hand, only the UK, France, and Italy placed multi-material packaging in the bottom spot – consumers from all other sample groups responded the least to aluminium foil.

Regardless of consumer perceptions, though, McKinsey reiterates that there is no silver bullet; that every packaging material brings its own benefits and drawbacks that can vary in effectiveness and sustainability between different applications or global regions.

Moving forward

With McKinsey recommending different approaches to suit the needs of each country, the report concludes by laying out five questions for packaging suppliers and consumer companies to ask in order to optimise their portfolios and develop future strategies:

- What are unique generational trends that can affect products over the next five to seven years?

- Which products are most at risk based on anticipated regulatory changes and consumer perception?

- What innovation and disruption are being pursued by competitors and innovators across key product areas?

- What are the potential growth opportunities in which the company would be uniquely positioned to provide winning solutions regarding sustainability and circularity?

- What are the nuances across demographics that can help better align products to end-market segments?

A survey of over 5,000 consumers conducted by Pro Carton previously revealed that two in three British, French, German, Spanish, and Italian consumers are actively pursuing a more sustainable lifestyle and 58% prioritise recycling in their efforts to combat climate change. Director of marketing and communications Winfried Muehling told us more.

Victoria Hattersley, senior writer at Packaging Europe, also elaborated on the value of understanding consumers’ mindsets in making meaningful progress – pointing out a growing understanding of the delicate balance between sustainability and functionality in packaging materials, and warning that consumers’ feelings about environmentally friendly packaging do not always align with their behaviour.

If you liked this article, you might also enjoy:

McKinsey on whether or not on-pack sustainability claims affect consumer spending

A deep dive into the most important packaging sustainability trends and solutions

No comments yet