From COVID-19 to sustainability, two experts from ExxonMobil - Francois Chambon, global strategic marketing manager for polyethylene and Etienne Lernoux, senior technologist - look into what the future holds for the flexible packaging market.

Growth in the packaging industry is currently being driven by two megatrends: global population growth and the expanding middle class. In comparison to today’s 7.5 billion, the global population is projected to reach 9.2 billion by 2040. Meanwhile, the global middle class is projected to grow by 66% from 3 billion to more than 5 billion in the next ten years, with people living longer, healthier, and better lives.

Improved living standards will lead to increased access to cars, appliances, and electronics. This is especially true in China, where GDP per capita is estimated to triple to more than $40,000 by 2040, which will be similar to the purchasing power in the European OECD (Organisation for Economic Co-operation and Development) in 2030.

Outlook for chemical demand growth

These megatrends will lead to an estimated growth in global chemical demand of nearly 45% over the next decade alone, or about 4% a year. This increase is greater than the forecasts for energy and GDP growth over the same period. The effect on the plastics industry is projected to include:

- Consumer demand for plastics, fertilizers and other chemicals will grow as incomes increase

- Olefins and aromatics are basic building blocks for plastics and other consumer products

- Manufacturers see plastics as lightweight, durable materials that can improve product performance, from packaging to automotive parts to medical devices.

Nearly all this growth is expected to occur in the developing world, with two-thirds in the Asia-Pacific region. India and China are expected to each reach middle class populations of more than one billion by 2040, driving demand for packaging and polyethylene (PE), in particular.

Packaging landscape trends

While demand for chemicals and plastics is being fueled by a growing global population and middle class, other trends are affecting the packaging landscape.

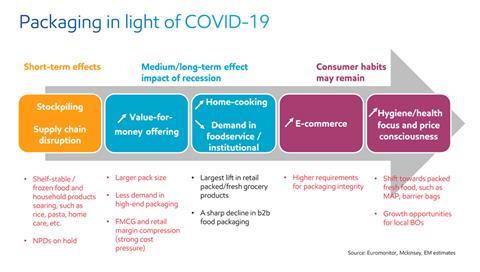

Pressure against single-use plastic: packaging value chain players and the public are expected to push for less single-use plastic waste. Prior to the outbreak of the COVID-19 pandemic, early plastic deselection was experienced at some retailers, especially in Europe.

Once the crisis has passed, a greater emphasis on package safety may be expected, as consumers’ sentiment shifts to “health and protection first”. Potentially this will change consumers’ views on packaging to be more hygiene-focused rather than sustainability-focused).

E-commerce and convenience: the rise of e-commerce and the increasing need for convenience are shaping new B2B and B2C customer expectations. E-commerce and home delivery businesses are experiencing a massive boost during the pandemic, but packages require better impact and puncture resistance because they are handled by more people compared to a traditional value chain.

For example, fresh meat packaging that leaks is the number one complaint in fresh e-grocery deliveries due to seal failure and puncture caused by sharp objects, careless handling, or poor packaging material choice. There has also been a shift from rigid to flexible packaging for liquid products, as enhanced integrity is required with e-commerce purchases.

Intelligent value chain: Industry 4.0 and Internet of Things (IoT) are transforming industrial production and creating new opportunities in the PE value chain. Helping to ensure traceability from package production to the final product being placed on the retail shelf, Industry 4.0 is expected to play an increasingly important role in ensuring that the package composition can be tracked, especially when recycled content is included.

Sustainability focus areas

The need for the packaging industry value chain to create more sustainable solutions will, however, continue to grow, focusing on three dimensions of using PE:

- “Design for recycling”: solutions that can deliver high-quality mono-material recycle streams which can then be incorporated into various next-step PE structures.

- “Upgrading recycle streams”: solutions that use compatibilizers to boost the performance of PE films that have been contaminated with foreign immiscible polymers such as EVOH or polyamide (PA).

- “Increasing recycled content”: solutions that allow recycled content to be increased by including ‘booster’ high-performance PE polymers to maintain mechanical properties of the final product.

Value chain collaboration is imperative in terms of increasing recycling rates while maintaining performance because the packaging must be functionally effective ― all with the goal of achieving the target of 10MT annually of recycled plastic used by 2025 put forth by the European Commission.

Design for recycling

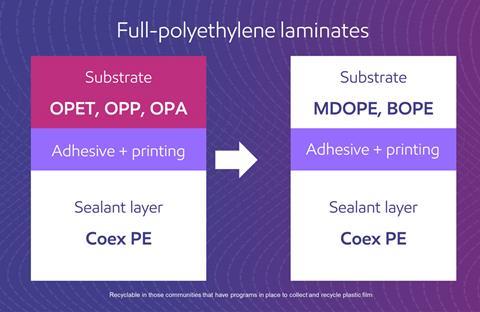

Many packaging structures have traditionally used composite structures (laminates), which often comprise a PE film, used as sealant, with oriented films such as polyester or PA films used as substrate. These multi-material structures can be difficult to recycle in mechanical recycling processes.

Solutions to replace these substrates with PE films that can be more easily recycled have been created in recent years and many new ones are in development. A particular focus has been oriented PE, either mono-oriented (MDOPE) or bi-oriented (BOPE). These PE//PE laminates can enhance recyclability and potentially contribute to a circular economy.

One success story is a full-PE laminated stand-up pouch (SUP) solution (the red & white SUP), to replace conventional multi-material structures. These full-PE SUPs can be easily recycled where programs and facilities to collect and recycle plastic films exist. This is step 1.

Step 2 is the recycled content full-PE stand up pouch (the green SUP). It is made of an MDO film using 100% virgin PE, laminated to a sealant film incorporating recycled material from the full-PE SUP of step 1. The recycled material is combined with virgin Exceed™ XP, Exceed™ and Enable™ performance PE polymers, and Exact™ plastomer products, to maintain the mechanical properties of the final SUP. This entire laminate combines 30% recycled content PE film with 70% virgin PE.

Delivering excellent packaging integrity, puncture, and optical properties, it is well-suited for non-food applications, such as detergents and dishwasher tabs. The SUP creation leveraged collaborative efforts with Hosokawa Alpine (film extrusion and MDO equipment), and Erema (recycling machinery) and Henkel, who developed optimized adhesives for mechanical recycling with improved processability during re-extrusion and reduced impact on odor and discoloration of the recycled material.

MDO for elongation resistance

The MDO process, which significantly enhances elongation resistance in the machine direction making PE films more robust for printing and lamination, is key to the success of the SUPs.

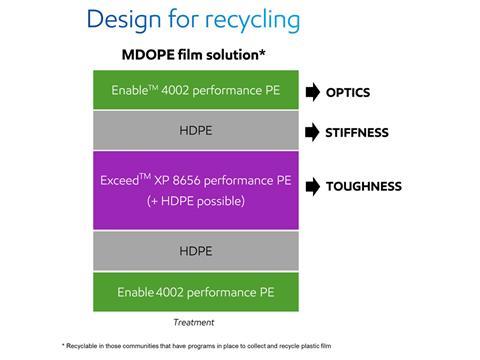

The film structure on the slide above shows a 5-layer PE film developed for MDO and lamination. Because many of today’s packaging machines are designed to deal with high heat-resistant laminates, significant amounts of high density PE (HDPE) must be added to the formulation to avoid, or minimize, heat distortion during sealing.

To ensure exceptional optical performance after MDO, medium-density Enable™ 4002 and Enable™ 4009 (0.940 density) performance polyethylenes are placed in each skin layer. They also impart excellent film optics at lower stretch ratios than other solutions, such as those using HDPE in the skin layers. Very good optics can still be achieved with only 4.6 times orientation, while HDPE resins need about 6 times typically. The converter can stretch the film less, minimizing the risk of splitting which is detrimental to production efficiencies.

To enhance mechanical properties and bag drop performance, Exceed™ XP performance polyethylene is added to the core layer. Some HDPE can also be added to the core layer if greater heat resistance is needed. This MDO film laminated to a PE sealant film delivers similar bag drop performance to OPA//PE laminates.

As for further developments, ExxonMobil is currently working on solutions that incorporate a gas barrier into MDOPE//PE laminates, while maintaining performance and opportunities to recycle.

Polyamide removal

Multi-layer coextruded structures containing PA can be a significant concern for recycling. These structures are typically used for thermoforming applications and contain 30 to 50% PA. PA is versatile, delivering conformability, puncture resistance, abrasion resistance, easy thermoforming, and barrier properties, amongst others.

Removing PA from these multi-layer structures is a key target for improving recyclability. Exceed™ XP 6026 and 6056 performance polyethylenes can be used to increase puncture resistance, while the thickness of the PA layer can be reduced. PA can be reduced by 30%, while puncture resistance is enhanced.

Development work is currently underway to achieve further reduction or removal of PA from these multi-layer films, as is development work regarding PE thermoforming films, or at least polyolefin thermoforming films, which can be readily recycled.

Upgrading recycled streams

Difficult to recycle, mixed polymer streams will continue to be a challenge for the industry for the foreseeable future. Compatibilizers that can bind polyolefins with incompatible polymers, while minimizing the loss of properties are being developed.

The effect of a compatibilizer on a PE + PA blend is shown in the two pictures. Without a compatibilizer, PA does not disperse well into the PE matrix, forming big inclusions that deteriorate PE properties. Adding an efficient compatibilizer helps disperse the PA into smaller inclusions and bind it with the PE.

The impact of a compatibilizer on properties can be immense. The chart highlights the performance of a compatibilizer based on MAH-grafted Vistamaxx™ performance polymer on a post-industrial recycle stream containing PE, polypropylene (PP), PA and EVOH. The structure represented by the shaded grey area is made of 100% recycled content and has a poor performance. Adding the compatibilizer significantly boosts mechanical properties such as dart, tear, and puncture resistance, as represented by the blue outline.

Increasing recycled content

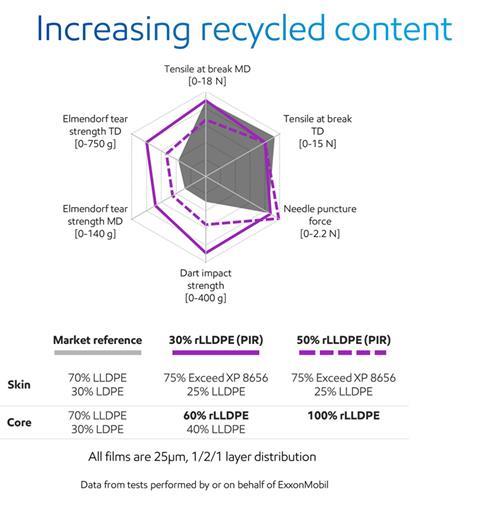

An issue related to increasing the recycled content in a formulation is the adverse effect it has on the properties of the final product. Adding high-performance polymers like Exceed™ XP can boost the properties.

The grey-shaded area in the chart represents a basic film structure, made with 70% LLDPE and 30% LDPE. As highlighted by the dashed purple curve, introducing 75% Exceed™ XP 8656 performance polyethylene in the skin layers allows the use of up to 100% recycled resin in the core layer, while fit-for-purpose film properties, similar to the reference film made with virgin polymers, are maintained.

Another way of considering the impact of a performance PE polymer on the entire film is that using 38% Exceed™ XP allows the introduction of up to 50% recycled material.

Using a similar concept, a collaboration between The Barbier Group, a leading PE film converter and recycler based in France, and ExxonMobil has resulted in the fabrication of collation shrink films containing 50% post-consumer recycled content and Enable™ 4002 performance polymer which acts as a performance booster. There is no degradation in mechanical properties for packages with minimal risk of breakage, and optical properties, such a gloss and transparency, allow brand owners to promote products effectively.

Conclusion

The pressure to develop sustainable solutions that do more with less and can contribute to a circular economy will continue and heighten over time. The collaborative efforts of the value chain in harnessing the power of these three technology focus areas will play a key role in the development of innovative solutions that offer sustainability benefits that meet evolving brand owner commitments, consumer expectations and regulatory changes.