Many food manufacturers consider digitisation will have a huge role to play in the future of the food sector – but the majority still see a number of hurdles that need to be overcome in order to maximise the opportunity.

This was a key finding of the 2018 CSB-System survey which canvassed the opinions of decision-makers within the food and beverage production industry across 29 countries. Respondents identified increasing retailer requirements, strict international legislation on food safety and traceability, and growing consumer demand for quality and freshness as key challenges that information technology (IT) could help to solve.

Potential benefits outlined included networked production becoming the standard, which will bring producers and consumers much closer together. Producers will be able to create increasingly personalised products cost-effectively and placing orders directly with the manufacturer will become more commonplace.

Although these factors mean that twice as many respondents than in the 2017 CSB survey rated IT as ‘very important’, the figure was still only 17%. Furthermore, only 15% of respondents spend more than 1.5% of their turnover on IT, while nearly 70% do not invest more than 1% in digitisation. This compares to medium-size US enterprises which, according to Forrester analysts, spend 4.3% of turnover on IT.

The survey identified the main barriers to digitisation to be lack of employee skills and low awareness of what solutions are available on the market. CSB says working with a suitable IT partner can help companies to tackle the four major issues that enable companies to move towards achieving a Smart Food Factory. These are a need for increased transparency; enhanced digitisation in marketing and sales; additional digitisation of factory processes; and improvements in quality and traceability.

ERP systems will have a critical role to play in this and will remain the focal point of many processes in food enterprises, as most companies are familiar with these systems and respondents saw many benefits. However, the survey found that they also think the demands on the systems can be too high, and they would like to see greater user-friendliness, advanced documentation capabilities and more analysis options for their existing systems.

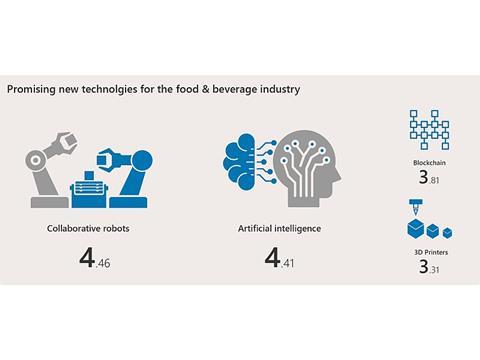

In terms of latest technologies that may have an impact on the food industry, collaborative robots and artificial intelligence were rated the most highly. Much less is expected of 3D printing and blockchain, with investment in 3D printing losing momentum after a promising start. Decision-makers do not currently see blockchain gaining a foothold in the food industry in the near future, although its adoption by large retail players such as Walmart and Carrefour may change this.

“Our survey demonstrated that there is a strong recognition among food manufacturers of the benefits of creating a Smart Food Factory, but there is still a lack of knowledge and understanding that is preventing many companies from investing heavily in IT and digitisation,” comments Frank Braun, CSB´s head of marketing.

“For many companies, therefore, selecting a suitable external supplier may provide the necessary support and guidance to maximise the many opportunities that digitisation offers, in particular in improving business performance and profitability.”