Folding cartons and corrugated have had something of a bumpy ride over the last two or three years, with production down last year and bottoming out during 2024. Neil Osment, MD of packaging market research company NOA, looks at what the next few years might have in store for these major paper packaging formats.

After soaring production demands during and after covid, the market for folding cartons became gloomier in 2023, and similarly (although a little earlier) for corrugated.

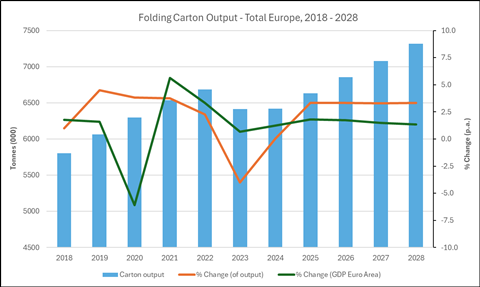

For folding cartons, orders began falling away in the last quarter of 2022, and during 2023 output fell by -4%. The slight saving grace was that the value fell by less (down by -2.2%), so clearly prices were kept up. This year, output looks like it will plateau.

The reason for the fall has been well documented. During 2023, product that had already been manufactured was being used up, having been stockpiled by packer/fillers, brand owners, folding carton converters and mills.

Warehouses were replete with finished and filled product, flat pack product was waiting to be filled, and board was waiting to go to converters.

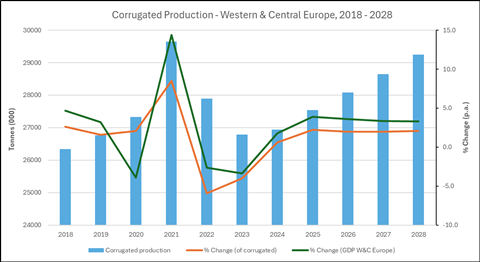

And what about corrugated? It’s a similar story. For corrugated – a more ‘just in time’ product – the rise in demand and subsequent fall away were much more rapid than for folding cartons. Here, output rose by a remarkable +8.5% in 2021, followed by two years of sharp decline: -5.9% and -4.0% respectively. 2024 has also been a year where decline in output has been bottoming out.

So, what does 2025 have in store for folding cartons and corrugated? Will it be the bounce-back year?

Good question. Here’s what we are predicting, at NOA.

Stocks have been depleted, which is good news – the age of ghost orders is over. But multiple factors are slowing demand, including the cost of living crisis, high energy prices for households and businesses, and inflation.

Geopolitics have also had an impact: the war in Ukraine, the Houthi attacks on shipping in the Red Sea near Yemen (affecting the supply chain throughout the last few years), and now military action in the Middle East. These will all negatively impact a bounce back.

It’s also important to remember that from the years 2021 to 2024 we have seen a rollercoaster of demand in all industries; we have been in completely uncharted territory. We believe we are now settling back into a more normal pattern, with figures for output and value in 2025 starting to return to 2020 levels.

And looking further ahead towards 2028? The future of folding cartons is dependent on a number of factors, not least the speed of plastic substitution and the technical advances enabling this to happen. Consumer opinion, brand owner response, legislation and the plastics industry will all play their part.

Just looking at technical advances, these are gathering apace due to the opportunity that plastic packaging volumes represent, creating clear opportunities for plastics substitution for end-use markets, particularly in the chilled, frozen and ambient food sectors. Growth rates are remarkable – dairy’s use of fibre packaging will be up 58.5% in terms of output, in the decade from 2018 to 2028.

One more thing to mention. Sometimes, as seen in the last 12 months, the plastic substitution trend can go in reverse. We’ve seen evidence of supermarkets switching some own-brand products from glass jars with metal lids to plastic bottles and plastic lids. A mono-material product, which is easier to recycle and less heavy to transport.

It’s an example of a retailer looking at legislation that is pushing towards reduced packaging weight and towards net zero, and trying to find solutions (in this case, opting for a solution that runs counter to the mood of the consumer).

In our view, the amount of legislation is overwhelming, confusing, and can often be unhelpful and distracting to business growth.

There is much that is up in the air, and – to a degree – we are using our NOA crystal ball to look into the future; 2025 to 2028 could see little growth but equally, we could see phenomenal growth. Let’s hope for the latter.

If you liked this story, you might also enjoy:

The ultimate guide to the Packaging and Packaging Waste Regulation in 2024

How are the top brands progressing on packaging sustainability?

Sustainable Innovation Report 2024: Current trends and future priorities

Everything you need to know about global plastic sustainability regulation

No comments yet