What is new in the area of smart packaging? Elisabeth Skoda looks at just a few of the latest developments in the sector.

According to a study from Smithers and Deloitte, between US$5 trillion and US$10 trillion worth of consumables are sold globally each year and the vast majority of them are packaged in some way, generating a packaging market of US$424 billion. Smart packaging therefore has the potential to create value and to disrupt traditional business models.

The global market for smart packaging is currently estimated at $5.3 billion and growing at CAGR of 8% for a projected value of $7.8 billion by 2021.

When ranking industries on a scale for stages of market adoption, ranging from introduction to growth and maturity, pharmaceutical smart packaging is in the lead, followed by liquors and spirits, cosmetics and food, with industrial products furthest away from maturity.

Unlocking the potential of QR codes

Connected packaging has emerged as a way for food and beverage producers to connect with consumers, and solutions like scannable QR codes can turn physical packs into interactive tools.

Aseptic packaging and system provider SIG researched QR code usage around the world. The company asked consumers in Brazil, Europe and China how they use and perceive QR codes on smartphone-enabled packaging.

China is leading the way

SIG first asked consumers how often they currently scan QR codes. In Brazil and Europe, usage rates were similar with just seven and eight per cent of consumers, respectively, scanning QR codes several times a week. In China, however, this figure rose to 50 per cent. This not only shows that QR codes are far more established in China but also that brands in Brazil and Europe could do more to promote their value to consumers.

“Consumers in both these markets scored QR codes highly for being innovative, useful and easy to use, as well as important for product peace of mind. But many also cited a lack of awareness as a major hurdle to scanning more often. To reach the high engagement levels seen in China, brands in Brazil and Europe therefore need to provide clearer information on what consumers stand to gain with connected packaging,” comments Ayed Katrangi, SIG’s senior product manager automation and digitalization.

Trust and transparency

By using fraud-proof printing technologies, QR codes can offer a viable way to increase product trust and transparency. In Brazil and Europe, SIG found consumers are particularly interested in production and expiry dates, as they want to learn about a product’s journey and quality. In China, meanwhile, confirmation of product authenticity is key with 94 per cent of consumers believing this is essential for product peace of mind.

“Connected packaging enables the collection of real-time data throughout the product journey – from sourcing, processing, filling, quality checks and logistics, right up to the supermarket shelf,” says Katrangi. “All this data can be linked to each individual package, so relevant and transparent information is always available to consumers.”

Scanning for the right reasons

For brands using QR codes on packaging, knowing the right consumer incentives is crucial. In all surveyed markets, instant free gifts – closely followed by cash back – is seen as the most important trigger to scan a QR code.

In China, scanning QR codes for financial gain is already a well-established practice. In fact, 65 per cent of consumers here think it’s the most important reason to scan – more important than peace of mind, shopping assistance, information or entertainment.

Entertainment equals engagement

With QR codes, consumers can access a wealth of interactive content with their smartphones, which can make a brand and its products seem more attractive. In Brazil and Europe, video content, including TV shows, movies and animations, is seen as the most appealing entertainment form for 56 and 40 per cent of consumers respectively.

In China, however, consumers are more interested in accessing online gaming with 59 per cent of consumers rating this as their preferred entertainment. In addition, per cent of consumers also want to broadcast their product interactions on social media, highlighting how consumers are looking to share and discuss brand experiences. On-pack entertainment emerges as a proven gateway for consumer engagement.

Enhanced shopping experiences

In addition to entertainment, QR codes can also facilitate more convenient shopping experiences. In Brazil (72 per cent) and Europe (41 per cent), consumers want to know the physical locations where they can purchase the relevant product. In Brazil, 75 per cent are ready to scan QR codes regularly to access online shopping assistance. In China, consumers are also interested in knowing where to buy a product, but the majority want to be taken directly to the product company’s website to shop via quick links.

“In all markets, it’s apparent that consumers are ready to switch to brands that offer more convenient online shopping assistance and options. QR codes provide an ideal platform for these enhanced experiences,” Mr. Katrangi says.

NFC and connected packaging

Packaging that interacts with smartphones has enjoyed great popularity in countries like China, but uptake in Europe and the US was slow, and the lack of engaging experiences and the need to download different apps to access functionality were roadblocks. NFC (Near Frequency Communication) becoming more widely available is beginning to change this.

“When Apple introduced support for their NFC framework, brands began to sit up and take notice. They are now increasingly willing to commit to NFC deployments at scale because of the business benefits it offers. These include new purchase insights, access to previously unavailable consumer data, and more effective consumer engagement which leads to increased brand loyalty,” says Cameron Worth, CEO and founder at SharpEnd – The Agency of Things ™.

Changing consumer behaviours have also played a key role in this shift. Connected solutions have become a seamless part of the consumer experience, he adds.

“Consumers are increasingly familiar with NFC technology, thanks to it becoming an intrinsic part of the familiar ecosystem people use every day, such as transport, access control, Apple Pay etc. As the technology continues its journey to mainstream awareness and usage, it’s a no-brainer for brands to look at how it can be incorporated into their products. Therefore, we should expect to see NFC and wider connected solutions become commonplace, and, in particular, more brands facilitating two-way conversations with their target consumers built around insights, data and personalisation.

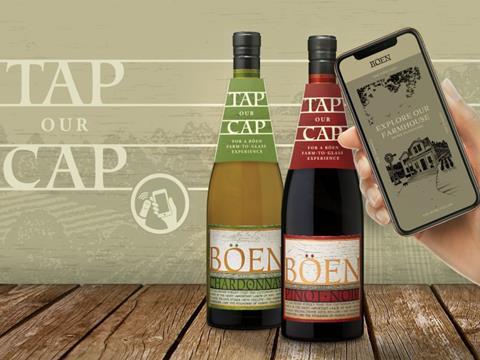

Learning about wine with a tap

A cooperation between SharpEnd, Guala Closures and Californian wine brand Böen gives consumers instant access to information about the wine they are purchasing by tapping the bottle’s cap with their smartphone with e-WAK®, described as Guala Closures’ first NFC-integrated aluminium closure for wine. Böen deployed the technology on its wine bottles, harnessing the power of NFC.

“Companies should think carefully about the technology they are using. The starting point should not be ‘what can I do with this technology?’, but ‘how will this technology enhance the consumer experience’? A clear purpose is beneficial to avoid technology for the sake of it,” Mr. Worth points out.

It was this approach led to the creation of the ‘tap-the-cap’, app-less format with the aim to offer consumers a frictionless experience. It gives direct access to an interactive farmhouse that provides services relevant to every stage of the consumer journey. This demonstrates of the possibilities of focusing on IoT as a creative challenge, rather than a technical problem.

Mr. Worth concludes: “There is increasing consumer demand for connected packaging across a range of technologies. We know from experience that brands who leverage connected packaging to drive engagement can learn more about what their consumers want and keep up with emerging trends.”

Forensic counterfeit-proof feature for pharma labels

A cooperation between Schreiner MediPharm and Applied DNA Sciences harnesses the potential of DNA to offer a new forensic authentication feature for pharmaceutical labels. DNA markers are deemed to be impossible to counterfeit and are recognized as forensic authentication evidence in courts of law. SigNature® DNA is a high-security feature based on DNA markers.

DNA molecular tags belong to the category of covert authentication features. They are based on uniquely modified, encrypted DNA sequences. Various multi-level methods to verify the covert authentication feature along the supply chain are available to informed experts: Beacon® technology, for instance, enables fast, reliable on-site verification by means of a decryptant liquid and a UV lamp. Specialized mobile devices may be used to authenticate the SigNature® DNA molecular tags as well. An extensive, forensic DNA analysis by a laboratory provides results that qualify as admissible evidence in courts of law.

Using conventional printing techniques, Schreiner MediPharm says it is able to flexibly and invisibly integrates this high-security technology from Applied DNA Sciences into existing label designs.

Prolonging shelf life and eliminating odours

SIAD, an Italian chemical group, has developed a solution to address the issue of unpleasant odours in fresh food packaging which sometimes occur even if there is nothing wrong with the food.

Aroma+ is set to solve the issue that can occur due to volatile and organic compounds of the food without changing the taste of the actual food product. A university study explored the benefits with regards to sensory and microbiological properties for sausages.

"We use natural aromas on a liquid base that we combine with the appropriate gas mixture for the MAP of the food. Rosemary aroma was used within the sausage packaging to address the issue of browning and smells of rancid fat and blood. Using the rosemary aroma with antioxidant properties, the original colour was retained until the end of the shelf life, and fat oxidation was reduced," explains Rhoman Rossi, a member of SIAD's marketing team.

Aroma+ was also tested for other fresh foods, such as fresh pasta and chicken, and the results showed a reduction in unpleasant odours until the end of shelf life.