AMI Consulting has published a new dataset laying out the challenges faced by the European plastics industry in 2022 and in the lead-up to 2027 regarding the industrial demand for polymers – including a shrinking demand for virgin polymers, competition from overseas markets, and the ongoing energy crisis.

The dataset covers all of Europe, including Russia and former members of the Commonwealth of Independent States.

According to AMI, GDP forecasts for 2022 ‘still look quite healthy’, with the IMF in its October update forecasting 2.6% growth for Europe – a figure that would apparently increase if Russia and Ukraine had been excluded. Advanced Europe is projected to grow by 3.2%.

On the other hand, the virgin polymer market is predicted to undergo a 0.4% decline in plastic consumption, although there are inevitable differences between polymers, processes, countries, and applications.

Fibre extrusion is identified as the weakest process, specifically in carpets and hygiene and medical nonwovens. The latter saw a surge during the COVID-19 pandemic via masks, gowns, hygiene wipes, and other PPE products; while some were imported from Asia, much of Europe’s supply is thought to have been produced within the continent and the demand for spunbond machines is reported to have been high. As the usage of PPE equipment phases out, AMI notes that demand is also waning.

Carpets, on the other hand, have apparently been in decline for decades, although the current energy crisis has caused costs to rise still further. European home carpets have reportedly been superseded by similar products sold on the Asian markets, which are thought to be cheaper solutions. Automotive carpet volumes continue to be impacted by weak production, according to AMI.

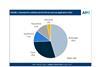

Injection moulding is reportedly in the middle of the growth profile. While it has undergone a slight decline, it is said to be the largest single process for virgin polymers in Europe. Once again, though, material, country, and application contribute towards variation in the results.

Sustainability concerns such as inter-polymer substitution in packaging and changes in automotive components due to electrification and lightweighting are suggested to contribute to these differences, whereas others are caused by economic change. For example, the automotive industry is said to be experiencing continual weakness.

Film is singled out as the strongest polymer application. It is apparently less sensitive to economic hardships than other polymers and experienced steady growth throughout the pandemic – progress that is expected to continue into 2027. However, even this is said to vary due to sustainability efforts and changing consumer trends.

A previous report by Flexible Packaging Europe (FPE) drew attention to tensions in the polymer market caused by fluctuation in volume and times of delivery – a sentiment echoed by the Polymers for Europe Alliance in its Polymer Supply Assessment 2021.

AMI has also highlighted polymer shortages, the fallout of the COVID-19 pandemic, and Russia’s invasion of Ukraine as driving factors behind rising prices and increasing complexities in the European shrink film market.

No comments yet