The 12th European Bioplastics Conference in Berlin was an opportunity to take stock of the extent and direction of growth and innovation in a segment that looks to have an increasingly prominent role in packaging. Packaging Europe’s Tim Sykes was among the 330 delegates seeking to map the future of bioplastics.

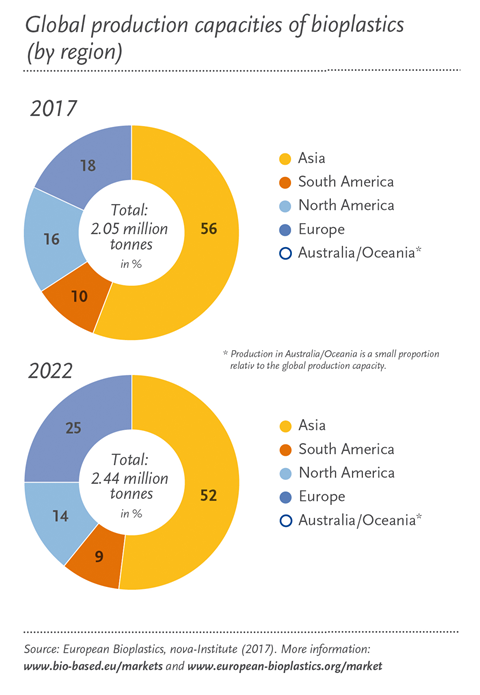

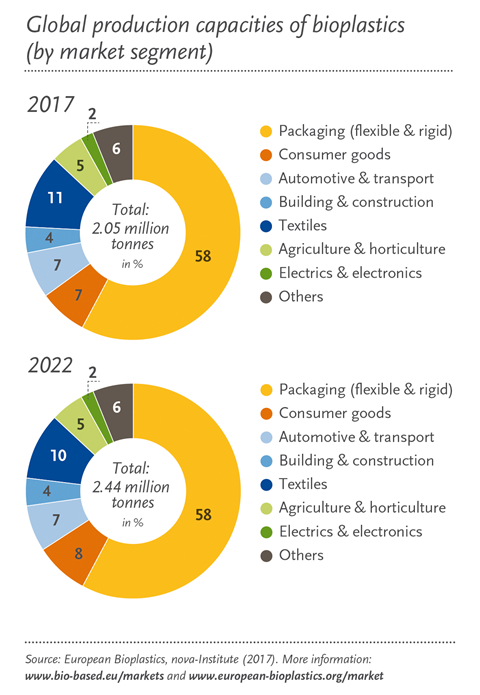

Perhaps the first take-home from the this year’s EUBP Conference is that geographically Europe and sectorially packaging are at the epicentre of bioplastics market growth at the moment. The packaging market accounts for (and is set to retain) 58 per cent of bioplastic production. Meanwhile, Europe is projected to increase its share of global production from 18 to 25 per cent in the coming five years. Since world production is predicted to increase by 20 per cent during the same period, this reflects a huge increase in European capacity – a fact underlined by the several manufacturers present in Berlin who announced plans to commence or scale up production.

Europe’s leading role in driving global growth can be attributed to proactive regulatory efforts. As Jean-Marc Nony of SPhere remarked, respective regulations in France, Italy and Spain have helped build up infrastructure across southern Europe, while the EU’s Circular Economy package is now laying the foundations for favourable market demand Europe-wide. As François de Bie, chairman of EUBP, remarked: “Europe is a world leader in developing and commercialising innovative biopolymers. The commitment of the European Commission to the transition to a circular economy and the stronger political support for the bioeconomy on the whole are crucial signals and are further accelerating the growth momentum of the bioplastics industry in Europe.”

Brand watersheds

Amid a challenging climate for plastics, with packaging waste and ocean plastics prominent in consumers’ minds, it’s clear that there’s a market pull as well as a legislative push. Presentations by leading brand owners and retailers emphasised the deliberation and substantive steps being made by consumer-facing businesses on sustainability approaches – with bioplastics prominently on the agenda.

Sandeep Kulkarni set out PepsiCo’s strategy, which takes its cues from the UN Sustainable Development goals and Paris Climate Agreement. Whereas the PepsiCo focus until the year 2015 had been on boosting internal environmental performance by improving production efficiencies, the October 2016 ‘Performance with Purpose’ review has shifted the emphasis onto total environmental footprints of its products. PepsiCo has pledged to reduce greenhouse gas emissions by 20 per cent between 2015 and 2030, and to work towards 100 per cent recyclable, compostable or biodegradable packaging by 2025. The adoption of bioplastics is therefore an acknowledged key component of its long-term sustainable packaging strategy.

Meanwhile, Françoise Poulat of Danone and Jean-François Briois of Nestlé Waters introduced the NaturALL Bottle Alliance – an unprecedented initiative in which the world’s number one and two bottled water companies are working together to create a next-generation bio-based PET bottle. The project expects to achieve industrial scale PET resin production featuring 75 per cent bio-based feedstocks by 2020, rising to 95 per cent by 2022. The initiative is fully LCA audited and is scrupulously avoiding diverting resources from food production, therefore planning to use second generation ligno-cellulosic biomass such as used cartonboard and sawdust.

Representing the retailer’s perspective, Kevin Vyse outlined Marks and Spencer’s ambitious Plan A 2025, the most revolutionary component of which is the One Polymer Roadmap – committing the business to move to use of a single plastic across all its private label packaging for simpler recycling. While a lot of work is yet to be done on identifying a polymer that ticks enough boxes across rigid and flexible packaging formats and diverse product categories, Mr Vyse hinted at a likelihood that the selected plastic would be bio-based. Could this be a watershed moment? Bearing in mind the pioneering record of M&S – who have previously, for instance, set the policy agenda with the introduction of carrier bag charges – there’s a distinct possibility that other retailers will follow this lead, and perhaps M&S will again anticipate the regulation.

Expanding possibilities

The third important driver of the bioplastics market is innovation, in full evidence at the EUBP conference both at the primary research and the product development levels.

A biopolymer we in the packaging industry probably need to start getting excited about is polyethylene furanoate, or PEF. PEF is a new, 100 per cent bio-based polymer whose properties are very similar to PET and recyclable within the PET stream. However, aside from its renewable credentials, PEF performs better than PET, offering remarkable shelf-life and downgauging opportunities in rigid and flexible (BOPEF) applications. As a carbonated soft drink bottle PEF has demonstrated six times better CO2 barriers and ten times better O2 barriers.

In view of the ease with which PEF can be introduced into existing PET processing and converting infrastructure, capacity is the primary challenge. BASF and Avantium’s joint venture Synvina is hurrying to meet expected demand, with efforts presently at pilot plant scale and product reaching the market by 2020. Meanwhile, Corbion has been developing a biocatalytic process to produce renewable FDCA as an alternative to terephthalic acid, as a monomer that can be polymerised into PEF.

Meanwhile, much discussion centred on the potential for biopolymers in flexible packaging – the most challenging material for our current recycling infrastructures due to the variety and complexity of substrates used. Biodegradable flexibles are a potential solution to this problem, with the added benefit that they may present an opportunity to divert food waste away from landfill (much as PLA coffee pods facilitate composting of packaging and grains). As such, developments such as biodegradable functional coatings (such as Fraunhofer ISC’s bioORMOCER®) and bio-based multi-layer barrier films (presented by Kuraray EVAL’s Stefan Corbus) may prove another significant pathway to sustainability.

Impressive material innovations abound across bioplastics. One highlighted at the conference by Marie-Hélène Gramatikoff, CEO of Lactips, is a water soluble, biodegradable thermoplastic made from milk protein. A key application for this is the dissolvable caseine pellets used for dishwasher detergents. This represents an alternative to soluble PVA and is claimed to be the quickest biodegradable plastic in the world. Finally, a mention ought to go to ICEE Containers’ fold-flat boxes – a solution for refrigerated products such as fresh foods and pharmaceuticals, using BASF’s ecovio® plant-based biofoam. ICEE has patented a moulded, living hinge in the substrate, which enables economical flat storage and transportation of this reusable, compostable format.

Thanks to a confluence of regulatory pressure, consumer demand, growing capacity and fast-moving R&D, we can be certain that bioplastics will be an ever more prominent element on the European packaging landscape. Needless to say, the 2019 EUBP Conference will be one of the key dates in the year’s diary.