The Single Use Plastics Directive (SUPD) came into force on 3 July 2021, and the associated recycled content mandates came into effect on 1 January 2025. It has been a major talking point in the European packaging industry for some time now, mainly due to the perceived lack of clarity and understanding surrounding this piece of legislation, and confusion around how the mandatory targets will be measured and enforced.

In this insight article, Matt Tudball, Helen McGeough, Valentina Di Micco and Carolina Perujo Holland of ICIS share what they know regarding the Directive and its implementation, address areas of uncertainty, and explain the impacts the SUPD has already had on the market.

What is the SUPD?

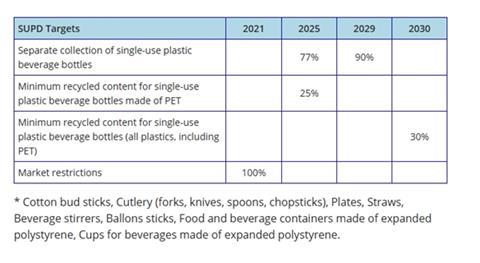

Based on Article 192 TFEU, the SUPD is a European Directive with the prime objective of reducing marine litter but also regulating the plastic industry by mandating targets for separate waste collection and minimum recycled content in PET beverage bottles detailed in the table below.

Key targets of SUPD

One of the issues with the SUPD – and one of the main areas of concern for recyclers and brands - is that due to it being a directive as opposed to a regulation, it is down to the individual Member States to transpose the directive into the domestic legal system through national laws.

What’s the difference between a Directive and a Regulation?

Unlike regulations, the entities called to comply with the obligations of directives are the Member States which translate the same obligations into national laws which in turn address the economic actors operating on the national market.

Member States are empowered to transpose the directive according to their own country-specific needs and may require the achievement of higher thresholds than those set by Directives.

For instance, under the SUPD, Member States are required to achieve at least 25% and 30% recycled content in beverage bottles but can demand the achievement of a higher percentage of recycled content in their domestic market as a result of the transposition, if they so wish.

The table below shows how Member States have transposed the SUPD into national law, but it is the way those same Member States monitor, measure and report the content of recycled plastics from 2025 that is one of the biggest areas of uncertainty.

Four years after the entry into force of the SUPD, all Member States have transposed the directive into law. Even though no country has mandated the achievement of a higher percentage above the minimum target required by the SUPD, significant differences have emerged on how Member States will calculate the attainment of the minimum recycled content target on the domestic market.

How are individual member states measuring the percentage of r-PET content?

Member States have fallen into three categories as shown in the table above. There is a lack of consistency across the EU 27 and this runs the risk of creating an uneven playing field in Europe and causes concerns for beverage brands placing the same product on different Member States’ shelves.

Below we break down the different measurements and what that means for those individuals operating in those markets:

- Per bottle

- 2 out of 27 Member States demand that each bottle must contain at least 25% minimum recycled content by 2025 and 30% by 2030

- Per Producer/Manufacturer

- 18 out of 27 Member States demand that the 25% by 2025 and 30% by 2030 targets are attained by each producer/manufacturer of beverage bottles

- Per national output

- 7 out of 27 Member States demand that the 25% by 2025 and 30% by 2030 targets are reached by the national output of beverage bottles.

The description above is based on our understanding of the national laws since no country has so far provided legal clarification about compliance with the national target.

Furthermore, in our view, the legal obligations for economic operators differ in the countries where the target is attained on a national level compared to the ones where the target is attained by producer/manufacturer or per bottle, with the latter being more burdensome for the bottle producing companies:

Per bottle- per producer/manufacturer:

In countries where the attainment of the target will be calculated per producer or manufacturer or per bottle, individual producers are to attain the target. Lack of compliance might determine financial sanctions or other penalties.

Per national output:

In countries where the attainment of the target will be calculated as an average of the national output, individual producers are not required to achieve the target.

Interplay between SUPD and PPWR

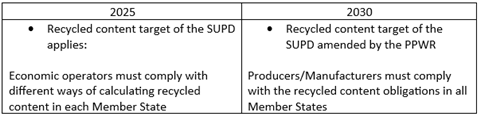

However, the entry into force of the Packaging and Packaging Waste Regulation (PPWR) partially changed some of the above-mentioned elements of the SUPD. The PPWR (Regulation 2025/40) has amended the SUPD as regards the recycled content obligations.

Section 180-182 of the PPWR states “The requirements related to the recycled plastic content for plastic beverage bottles as of 1 January 2030 should be deleted from Directive (EU) 2019/904 [the SUPD], as this matter is exclusively regulated by this Regulation. The corresponding reporting obligations should also be deleted.

“As this Regulation does not regulate the recycled content in the plastic part in packaging before 1 January 2030, provisions regarding requirements for recycled content for plastic beverage bottles in Directive (EU) 2019/904 should remain in force until that date”.

Hence, the 30% by 2030 target in the SUPD will be deleted and the 30% by 2030 target in the PPWR will be the only legal obligation for recycled content in beverage bottles existing in the plastic recycling framework.

Therefore, if Member States were called to comply with the 30% by 2030 target in the SUPD and were empowered to adopt different implementations, with the PPWR the economic operators are the ones called to comply with the 30% recycled content target by 2030.

Some Member States had already transposed the SUPD (including the 30% by 2030 target) shifting the compliance obligations onto the economic operators.

To sum up, the table shown above displaying the different national implementation of the recycled content obligations applies only for the 25% by 2025 target while the 30% by 2030 recycled content target in the SUPD must be achieved by the producer/manufacturer as stated in the PPWR.

What are the penalties for non-compliance for economic operators?

This is probably the biggest area of uncertainty as to date no member state has explicitly stated what happens after 1 January 2025 if a PET beverage bottle contains less than 25% r-PET content.

The lack of clarity is in contrast with the wording of the SUPD, which clearly mandates that Member States must lay down rules on penalties applicable to the infringement of national provisions, penalties which must be ‘effective, proportionate and dissuasive’ as stated in Article 14.

Three countries have made provisions in national law for the penalties but even here there are clear differences in the penalty amount and how it will be calculated, and the details behind each country’s approach to calculating and enforcing these penalties are not currently clear.

- Latvia – fine from 28-1,040 units where one unit of fine is €5 (fine from €140 to €5,200)

- Germany – up to €10,000 fine

- Greece – 1% of specific turnover of plastic bottle production

So far all governments have failed to shed light on the legal consequences of the lack of compliance with the recycled content targets. In some cases governments might intend to force compliance with the legal target through means other than a straight-forward financial sanction, for instance through the intermediation of Extended Producer Responsibility schemes (EPR schemes for packaging are mandatory for all Member States from December 2024).

One example to prove this point is an article of the Italian transposition which states that “Extended producer responsibility systems guarantee separate collection for recycling and compliance to the minimum percentages of plastic recycled use” (Art.9).

What are the penalties for non-compliance for Member States?

If Member States do not achieve the 25% recycled content target by 2025, Member States will be most likely subject to infringement procedures by EU authorities and ultimately a fine by the EU. The fine will be paid by the State budget (therefore taxpayers) without repercussions for single producers.

What is the r-PET market saying?

Even after implementation, the lack of clarity across many aspects of the SUPD is still a major source of frustration and concern for the r-PET market.

There were expectations at the start of 2024 that demand for r-PET would increase as the implementation date came into effect and not all Member States were meeting the required 25% recycled content.

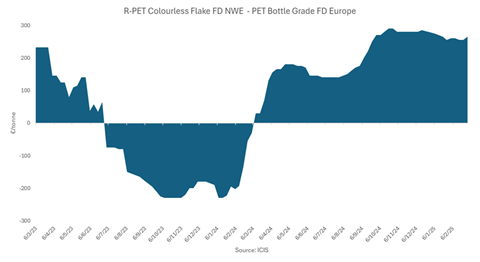

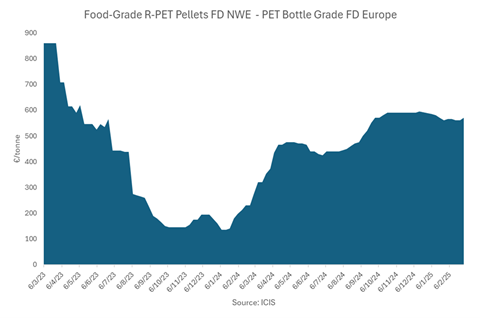

There has been a steady increase in demand for r-PET since the SUPD came into law in 2021, and some of the spike in demand and prices in the first half of 2022 can also be attributed to buyers looking to secure supply early, but that disappeared in 2023 as the cost of living crisis saw companies focus on cost saving rather than sustainability.

A surge in r-PET flake demand during Q1 2024 – unusual at the start of the year as flake and pellet demand generally picks up from Q2 when preform production ramps up for the summer peak season – was partly due to new food-grade pellet production capacity seeking out additional flake volumes for feedstocks, but this slowed significantly since May 2024.

The low PET prices are also having a significant impact on r-PET flake demand too, with some flake producers and sellers lowering prices in November due to competition from lower-cost virgin PET.

As chart 1 below shows, the spread between the mid-point of the free delivered (FD) Europe PET bottle grade resin price and the FD NWE Colorless (C) r-PET flake price, while chart 2 shows the same PET price compared to mid-point of the FD NWE food-grade pellet price.

As of March, the spread between PET and flake stood at over €260/tonne, and the spread between PET and food-grade pellet stood at over €550/tonne.

With significant cost savings on offer by using virgin PET, there continue to be conversations amongst r-PET market participants about beverage brands reducing their recycled content, particularly those who had put a more ambitious target of between 50-100% r-PET in place. However, most seem to be sticking to at least 25% r-PET content in line with the SUPD.

What can we expect in 2025?

r-PET market participants are reluctant to comment on the short-term outlook for the market other than that they hope for a pick-up in demand during 2025, but the extreme volatility the market has experienced since 2020 makes looking ahead very hard to do.

So far during 2025, several flake sellers have seen better-than-expected demand for January and February, and the outlook for March is also looking positive, with some sellers attributing this to demand for flake from the beverage sector.

But this same level of demand has not been present in the food-grade pellet sector, which has seen a much slower growth in demand to date in Q1 2025. Sellers and pellet producers have seen some new customers appear in the market looking to increase their r-PET usage, but the volumes are lower, and the uptake is not as pronounced as seen with flake.

We may see one or more member state come out with a clear and significant penalty for non-compliance that could be the catalyst for either demand in that particular country to pick up, or even for other Member States to confirm their own penalties, which in turn could cause a rush on the market and a spike in both demand and prices.

The role of imports are also under question. With structural shortness in Europe, imports of bale, flake and pellet have been actively used in the market. The regulations make clear imports must be compliant to all the regulations for food contact materials including EFSA requirements, source of feedstocks, and auditing standards being key aspects.

Being compliant to regulatory requirements may not be enough to support the use of imports, given the drive for a circular economy and therefore the use of domestic waste being a key component to delivering this. It is likely, however, that imports will persist in the market given the supply/demand imbalance. It is the responsibility of the value chain to ensure materials used are compliant and certification and reporting requirements are met.

ICIS has looked into the SUPD and the text of Implementing Decision 2023/2683 (the calculation of recycled content in beverage bottles) and can see no evidence to say that the recycled content must originate from the EU and not from a third country.

Decision 2023/2683 does reference Regulation 2022/1616 on recycled plastic materials and articles intended to come into contact with foods, and it could be, maybe, that a provision on the origin of the bales is in this Regulation (which deals with contamination of feedstocks etc.) could be leading to the confusion around the status of imports.

Compliance of recycled materials to the many regulations within the region, from sources of waste, to safety of materials in contact with food applications are applicable to imports as well as domestic supply. This could be the key stumbling block for exporters being able to sell recycled materials into the region. But also poses a challenge for buyers to ensure they are sourcing compliant materials, at all times.

The fact that this level of confusion is still present in the r-PET market at this stage of the timeline shows just how little clarity, or certainty there is amongst market participants that they are doing the right thing in progressing towards the 25% target.

Ultimately it will be the decision of the brands as to whether or not they look to imports to help meet the 25% requirement, but whether this creates a truly circular economy within the EU by dealing with the EU’s own waste is open to debate.

There is an expectation that virgin PET producers will increase their presence in the recycle market as several of these producers are looking at increasing the output of blended PET/r-PET pellets, otherwise known as flake to resin (FTR) or hybrid pellets during 2025.

The PET producer uses r-PET flakes during the virgin PET pellet production route, adding up to typically just over 30% r-PET into the production process which results in a single pellet containing a mix of both PET and r-PET. This pellet would then enable the customer to achieve the 25% recycled content, based on the weight of the bottle i.e. excluding cap, neck ring and labels.

This reduces the need for converters/brands to purchase both PET and r-PET material, cuts down on storage (a potential issue for smaller converters with limited storage capacity) and can give a more consistent blend of feedstock rather than having to add and blend two different materials through one line.

If producers do go down the blended pellet route, they will have to compete with other market sectors to secure the bales and flakes needed to produce the blended pellets. How this plays out is unknown, but it is likely the PET producers will be targeting higher quality bales and flakes to feed their production lines, putting them in competition with food-grade pellet producers as well as sheet and thermoform producers.

At the time of publication, many participants in the r-PET market in Europe have not seen any noticeable change in demand for material which they can directly attribute to the advent of the SUPD at the start of the year.

Some sellers are seeing better-than-expected demand during Q1, but this could be linked back to buyers stocking up on material in anticipation of higher demand and less availability during Q2 and into the summer months when PET and r-PET demand peaks.

Economics have beaten the mandates in prioritizations by bottle producers and how long this will persist will be determined by action from government and legislators. Until the first penalty is put in place, or the first audit is carried out to check the recycled content in a PET bottle in any given Member State, it seems the SUPD has failed to increase r-PET demand and recycled consumption above that of traditional seasonal trends, for now at least.

If you liked this story, you might also enjoy:

Reuse vs. single use – which is better for the environment?

Sustainable Innovation Report 2025: Current trends and future priorities

What can the world learn from South Korea’s world-leading performance in plastics circularity?

No comments yet