Polypropylene (PP) is one of the most widely used plastics, yet it has comparatively low recycling rates. A recent market analysis from PreScouter examined the current state of the recycled PP supply chain. Report co-authors Dr. Marija Jovic and Dr. Daniel Morales share their key findings and recommendations on what brands and recyclers need to do to bridge the gap between PP recycling capacity and post-consumer recycled (PCR) plastic demand.

Polypropylene (PP) is the second most commonly used plastic worldwide. However, PP recycling rates are significantly lower than other plastics, such as high-density polyethylene (HDPE) and polyethylene terephthalate (PET). For example, PET bottles are recycled in the US at a rate 3.5 times higher than PP containers. This discrepancy is mainly due to differences in household collection rates.

Many consumer goods companies are now setting Environmental, Social, and Governance (ESG) goals that require at least 25% recycled content in their packaging by 2025 or 2030. As a result, there has been a significant focus on recycled polyethylene terephthalate (rPET), which has led to comparatively less attention on recycled polypropylene (rPP) because of its inherent recycling challenges. Nevertheless, our market analysis reveals a viable and promising pathway for recycling PP, which can assist CPG companies in achieving their sustainability goals.

Capacity vs demand: Polypropylene market dynamics

US recyclers have the processing capacity of post-consumer recycled PP (PCR PP) to meet demand but lack sufficient input material and long-term commitments from brands to create sustained demand.

These findings emerged from our two-month study, which combined database reviews and interviews with recycling industry representatives. This methodology allowed us to estimate the total capacity for post-consumer PP in the US and gather insights into key metrics (i.e., material grades, facility numbers, partnerships, and key challenges).

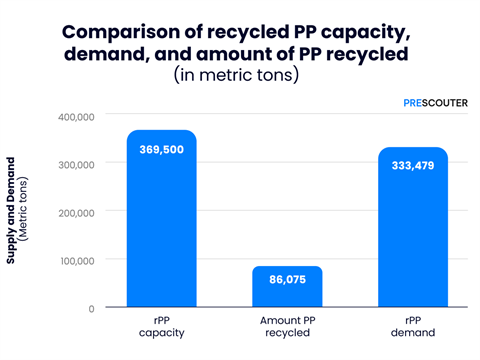

We found that recyclers have the processing capacity to meet the rising demand for rPP. As of 2024, US recyclers have a minimum capacity of 369,500 metric tons of recycled polypropylene, exceeding the demand to meet the US Plastics Pact’s 30% recycled content target. However, only 86,075 metric tons of PP are currently being recycled.

These findings suggest a substantial opportunity for recyclers, manufacturers, and brands to boost rPP production. Moreover, given the high usage of PP, investing in the supply chain for PCR PP is essential for companies aiming to meet their ESG goals.

Key challenges for PP recycling

A few key challenges surfaced as we spoke to over a dozen PP recyclers.

The primary challenge is linked to demand and supply, constraining the broader adoption of PCR PP and causing a cost disparity between recycled and virgin resins. Companies struggle to justify the higher price of PCR PP, even when recognizing its environmental benefits.

As one company we spoke to noted, ”Everyone brings PCR to the table, but when you tell them how much it is, they don’t always want to pay for it.” While blending percentages from 25% to 60% can help reduce costs, price sensitivity remains a major obstacle.

Material contamination further complicates supply. Post-consumer waste is often too contaminated for more specialized applications (e.g., food packaging). One company noted, ”Finding enough clean supply from post-consumer for food packaging is difficult. Post-industrial waste is an option, but post-consumer materials stay contaminated.”

Dwindling clean supply exacerbates contamination issues, confining PCR PP to lower-value applications. As one recycler stated, ”Supply is going to dwindle, and materials will be highly contaminated, only usable for commodity applications.”

Processing challenges, such as speed, consistency, and cost, add another layer of complexity. Brand owners’ preference for natural hues conflicts with the fact that most PCR PP resins are typically gray. This aesthetic preference complicates adoption in applications requiring specific visual standards.

Finally, regulatory pressure is another key driver, yet its impact is inconsistent. Many potential buyers find paying fines more economically feasible than investing in PCR PP. PreScouter sees the need for stronger enforcement to incentivize adoption. One source emphasized, ”Regulatory pressure is the key to driving more demand, though companies may find it more economical to pay fines.”

Despite challenges, capacity to double by 2030

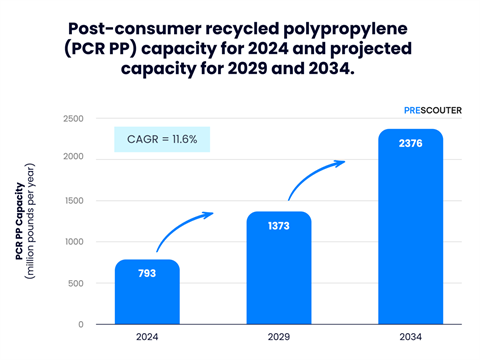

US PCR PP recyclers are optimistic. The market is experiencing strong growth, reflecting a projected CAGR of 11.6%.

This growth will be driven by the increased demand from already established brand partnerships. Nearly half of the interviewed suppliers expressed plans to expand capacity, contingent on sustained demand and strategic agreements.

Currently, 38.5% of companies are working with partners to strengthen supply and demand. The advantage of partnerships is that they can help secure guaranteed orders, assist with regulatory processes, including FDA approval, and address supply shortages.

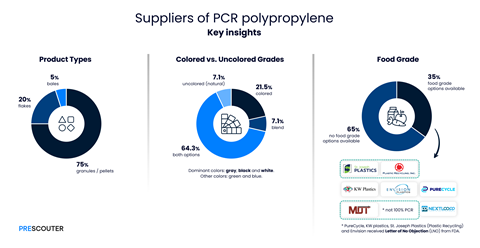

For example, PureCycle Technologies is leveraging its partnership with Procter & Gamble to optimize design and scale production. KW Plastics is working with material collections but not with outside investors. Over ⅓ of companies interviewed stated they could increase PCR PP production with the right partnerships and funds.

The US currently has the capacity to supply PCR PP, mostly in the form of granules or pellets, in a mix of colored, uncolored, and blended grades. The most common end-use applications include consumer goods, automotive, and packaging applications. 35% of interviewed suppliers can provide food-grade materials, with 4 having a letter of no objection from the FDA.

Brands must step up for a win-win scenario

Scaling rPP adoption requires a holistic strategy to ramp up industry partnerships, close regulatory gaps, and incentivize consumer participation.

Partnerships are essential to overcome supply shortages and ensure consistent quality. Collaborative efforts between recyclers, brands, and technology providers can address current barriers, such as contamination and the lack of high-quality feedstock for various applications.

We believe that regulatory alignment is a key enabler. While California and Colorado have implemented regulations on recycled content and Extended Producer Responsibility (EPR), the absence of such frameworks in most states limits progress. Uniform nationwide regulations could provide the clarity and incentives needed to drive supply and demand for rPP.

Finally, consumer engagement remains an overlooked but vital piece of the puzzle. Recycling infrastructure can only be effective if consumers actively participate in the process. This requires educating the public on the importance of recycling, building trust in the recyclability of products, and encouraging behaviors that reduce contamination at the source.

PCR PP companies are growing, demand is improving, and most suppliers say their businesses have the capacity for expansion. The insights we’ve gleaned from suppliers and the examples provided show that PCR PP barriers are surmountable.

If you liked this story, you might also enjoy:

Reuse vs. single use – which is better for the environment?

Sustainable Innovation Report 2025: Current trends and future priorities

What can the world learn from South Korea’s world-leading performance in plastics circularity?

No comments yet