In this comment piece, Mark Victory, Senior Editor, Recycling at ICIS, explores the reasons behind a rising disconnect between virgin and recycled polyolefin prices.

Traditionally the link between virgin and recycled prices was strong in Europe. Price movements for recycled material broadly mirrored virgin values, albeit at a lag and a discount. Because of this, it was relatively common to see contract prices linked to virgin movements.

The growing backlash against single-use plastics seen in the past few years, along with underinvestment in collection facilities has seen a growing disconnect between virgin and recycled values across the three majorly traded recycled polymer - recycled polyethylene terephthalate (R-PET), recycled polyethylene (R-PE) and recycled polypropylene (R-PP).

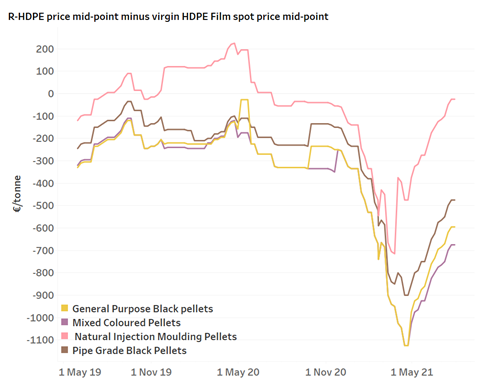

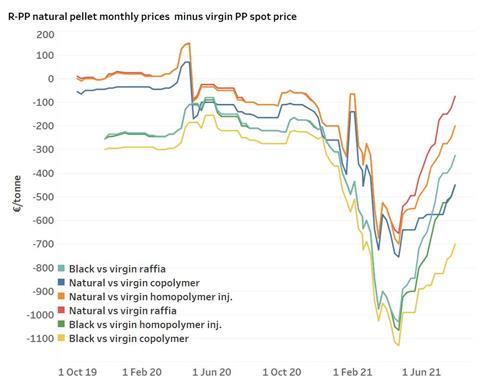

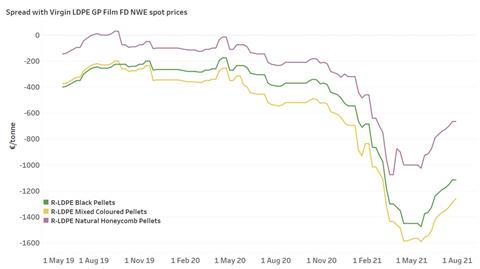

The unique economic conditions created by the coronavirus pandemic, meanwhile, have intensified volatility and added uncertainty. Both the disconnect with virgin and the growing market volatility are underscored by the fact that in a 12-month period during the height of the pandemic between April 2020 and April 2021, recycled high density polyethylene (R-HDPE) and R-PP values saw both their least competitive level with virgin values on record, and their most competitive level with virgin values on record.

During the first half of 2020, the coronavirus pandemic had a negative impact on recycled polyolefin prices. This was partly because of the wider reduction in demand in key end-use sectors such as automotive, construction and retail, partly because of workforce and logistic disruption, and partly because of packaging projects being pushed back. Packaging projects were pushed back due to a combination of lack of lab testing space, unwillingness to start new supply routes while logistic disruption was at its peak, and a reduced focus on sustainability during the pandemic. Since the second half of 2021, though, demand has been recovering - particularly from the construction and outdoor furniture sectors, where consumers have been concentrating on home improvements while movement restrictions were in place.

Since the start of 2021, renewed consumer and regulatory pressure and the easing of some covid restrictions, has meant that packaging projects have started to be onboarded. Coupled with this, virgin polymer shortages in the first half of 2021 have created substitution demand for recycled materials. With sustainability targets intensifying, it is unlikely that all of the increased demand for recycled polyolefins will substitute back to virgin polyolefins once virgin supply eases. Virgin shortages forced some players to use recycled material in their production to keep plants running, and in effect brought forward and shortened supply-chain testing and integration.

Within the past two years, natural grades of rigid recycled low density polyethylene (R-LDPE), R-HDPE and R-PP have all traded above virgin values for the first time. Natural grades are the grades most commonly consumed by the packaging industry, where sustainability pressure is at its highest.

Underlying demand for recycled polyolefins is growing sharply from the packaging industry, and it is now the predominant end-user of some grade of recycled polyolefins, such as natural material. Packaging companies are increasingly prioritising sustainability commitments over cost-savings against virgin.

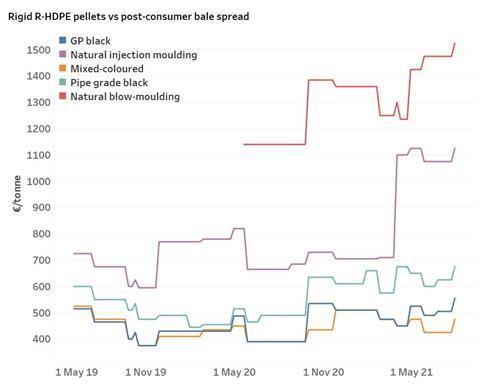

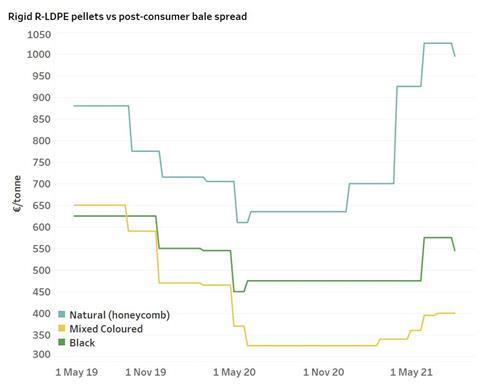

Nevertheless, the majority of recycled polyolefins are currently consumed by non-packaging applications, which typically purchase based on cost-saving against virgin.Sharp changes in demand for various end-uses, along with a structural undersupply of packaging and bale values have resulted in increased volatility in the spreads between pellet and bale prices. It is no longer just the relationship between recycled material and virgin values that has disconnected, but there is an increasingly volatile relationship between bale values and downstream pellets across recycled polyolefin grades.

The majority of polyolefins are produced from mixed-coloured waste bales, which are then colour separated. The price of waste bales is generally dictated by the overall demand for recycled polyolefins versus current waste bale availability, which can lead to a disconnect with sector by sector end-use demand in, for example, the packaging or construction sectors.

At the same time, since the start of 2021, bale supply has become increasingly short due to structural undersupply and a lack of sufficient sorting capacity. Some players expect bale shortages to last at least until the end of 2021.

The availability of recycled polyolefins material remains insufficient to meet packaging firm targets, which are typically for a minimum of 25% recycled content by 2025, and often as high as 50%.

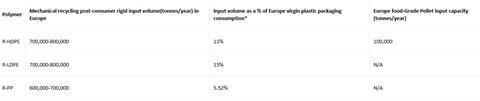

The table below uses ICIS supply & demand data for Europe virgin demand to show the maximum volume of packaging demand recycled material could supplant if every tonne of rigid polyolefins processed in Europe were used by the packaging industry.

Not all waste material, though, is suitable for recycling back into packaging material, and typically only the natural fraction of waste is currently used in recycled packaging. Natural material comprises around 10% of bale volumes, according to market estimates, meaning that there would currently be enough material to substitute just 0.5-1.5% of polyolefins packaging demand.

Growing underlying demand for recycled material has seen virgin polyolefin and recycled polyolefin values largely decouple. It has also seen the spread between bales and downstream recycled material become increasingly volatile.

Additional demand for recycled polyolefins is likely to embed this decoupling further. Five years ago players could look to virgin prices for an indicator of where recycled polyolefin values were likely to be. This is no longer possible, and players increasingly need to track the market conditions for individual grades of material across the value chain.