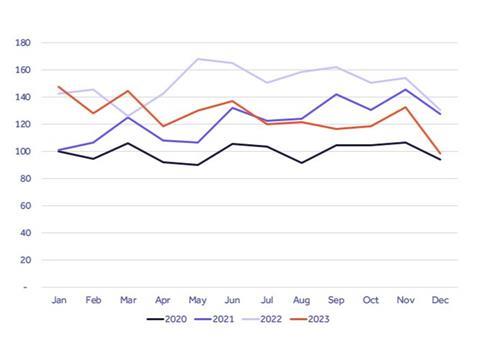

Analysis of millions of invoices on the supply chain finance platform, Demica, has revealed the value of sales in paper and packaging and transport and logistics sectors fell by double digits in Q4 of 2023, compared to Q4 of 2022.

Apparently, sales values in paper and packaging fell by 20% in Q4 of 2023 and sales values in transport and logistics fell by 14% in Q4 of 2023 compared with Q4 of 2022. The figures form part of the Demica Index – an analysis of trade receivables from 1,200 large corporate companies in Europe and North America.

Demica states the fall in paper and packaging sales value correlates to struggling retail sales in Q4 of 2023. The December drop in values is notably steeper than in previous years. It adds that packaging businesses have struggled to boost demand since the end of Covid-related restrictions shifted consumer spending away from online shopping to other services.

Demica highlights that, in the UK, December 2024 retail volumes fell by 3.2%, according to the Office for National Statistics. 62% of British adults said they are spending less on essentials because of cost-of-living increases.

In its analysis, the Deloitte Consumer Tracker said the consumer focus on Black Friday and promotions in November was not enough to offset an unexpected downturn in sales during Q4. By contrast, Demica says consumer spending in the US was travelling in a much more positive direction. “Non-store sales”, which are mainly online, grew by 8.4% year-on-year in Q4.

The drop in transport and logistics sales values is indicative of uncertainty sparked by the outbreak of hostilities in the Middle East in October and the continuing effects of the Ukraine conflict, inflation and high interest rates, says Demica.

The platform cited an industry outlook from UPS showing the demand for freight transport was down in Q4 among major carriers. In Europe, Demica says inflation and underperformance by the German economy also had an effect. While the German economy contracted 0.3% in Q4, according to the Federal Statistical Office, annualized inflation within the European Union was 3.4% in December.

Demica says air freight rates have dropped internationally since 2022 but were reported to be flattening out towards the end of Q4. However, seaborne freight continued to see a weak level of demand and declining rates.

The platform states the transportation and logistics sector continues to face pressures from labour shortages and the global regulatory push to reduce emissions. While the logistics industry is growing, the pool of available labour is constricted, with the consequences of staff shortages keeping wages high and increasing working capital requirements.

In similar news, a report from Plastics Recyclers Europe has warned Europe could miss legislative targets due to a 7% decline in the growth rate of European installed plastics recycling capacity, attributed to attributed to heavy European market disruptions since 2020.

On the other hand, Henkel recently revealed its 2023 Sustainability Report, with findings including the worldwide share of recycled plastic increasing to 19% and a 61% reduction in CO2 emissions in production. With a particular focus on the use of renewable energies and the promotion of the circular economy, the company stated the share of purchased electricity from renewable sources increased to 89%.

If you liked this story, you might also enjoy:

The Brief: How viable is biorecycling for plastics?

Report: How the top brands are progressing on packaging sustainability

The Brief: Using ocean-bound plastic in packaging – how, why and should we?

No comments yet