Inkjet is being applied successfully in most markets and all regions globally – the more specialist the market, the higher the growth rate. The cost of inks remains an issue, but for those investing in inkjet, service support is the key criteria followed by overall cost considerations.

The 5th Global Trends Report, published at the end of April, is well established as a unique annual survey of the state of print in all markets across the world. However by definition it cannot analyse all issues in the depth the drupa team would like. Hence the Spotlight report will take one important topic each year and ask our expert panel to examine it in more detail. This year it is the impact of inkjet printing.

Until 2008 for all but the ultra high volume applications, there was a straight choice between offset and digital toner production. However, over the last few years there have been rapid inkjet developments and a lot of the initial challenges around print quality and the range of substrates have been overcome. Inkjet is now viewed as a mature and stable process, capable of producing high quality images on a range of different substrates. So it was time for a global survey on the impact of inkjet printing.Whilst the 300 participants (203 printers and 99 suppliers) were on balance enthused by the opportunities for inkjet print, they were far from naïve – understanding its limitations and in many cases still working out how best to exploit its merits. What was striking was that all the detailed results showed virtually no regional variation. Equally, there was in general close alignment in views from printers and suppliers.

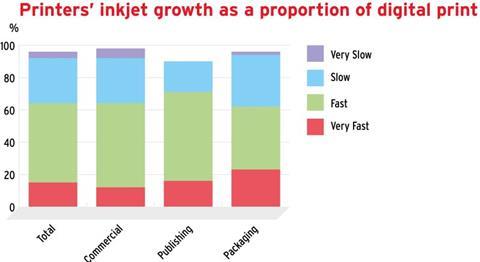

In terms of applications, printers are finding competitive opportunities for inkjet in all market segments (the full report gives a full breakdown of participation by end market). Equally important is the fact that printers are finding they can apply inkjet in multiple markets, creating the opportunity to enter new markets not in their traditional core sector. Participants reported strong growth in all sectors; but the more specialist the market, the higher is the growth rate.

For many the cost of inks remains the core issue restraining growth. However, where an inkjet application can fit to a specialist market then growth can be impressive. One supplier expressed it well:

“Understanding the value stream is key to selling inkjet. The focus has been on applications where good alignment exists, but these are increasing rapidly.”

Supplier, Great Britain, Packaging and Commercial sectorsIt was clear that some formats are better suited to particular markets. So whilst rollfed was the favourite in most markets, B2 sheetfed was also a popular choice in many markets. This despite comparatively modest worldwide sales of B2 inkjets so far, compared to liquid toner B2 presses that arrived on the market around the same time.It is important to put the development of inkjet by suppliers in perspective. 46% of suppliers reported that inkjet represented less than 10% of total turnover as yet. Clearly some specialise in inkjet, while others offer inkjet as one of a range of processes e.g. digital toner or conventional offset/flexo.However virtually all suppliers are investing heavily in the technology with significant research and development funding.

For those printers investing in inkjet, the dominant consideration when choosing a supplier is the level of service support followed by the price of the complete commercial package.

Sabine Geldermann, Director drupa, Messe Duesseldorf stated in summary, “The key question for anyone considering the purchase of inkjet print technology is that it needs to be the right fit for the desired applications. Market-changing process improvements can only be achieved when the technology provides the desired running cost, productivity levels, print requirements, size, substrate suitability, and workflow automation tools. New advanced inkjet systems have brought the disruptive capability of inkjet to a new level. Higher quality inkjet for both cutsheet and rollfed has arrived and is bringing digital print to a broader range of applications across all market sectors.”Two complete quotes from survey participants spell out the positive future for inkjet literally:“It's the Future” Supplier, Spain, Packaging“Futuro” Printer, Colombia, Publishing

The full Spotlight report on inkjet will be published at the end of May and is made available free to all who completed the survey. Both it and the full 5th Global Trends Report will be available in English to purchase from www.drupa.com.