Plastics Recyclers Europe raises concerns that the EU might miss the Packaging and Packaging Waste Regulation’s recycled content targets for 2030 by two million tonnes, pointing to a plateau in rigid HDPE and PP recycling in 2023.

Europe is in a plastics recycling recession, the organization has cautioned, with the downward trend attributed to increasing recyclate imports from outside the EU. These sometimes come with “questionable claims” of recycled content and “no effective verification and traceability measures” in place.

Cheaper virgin and recycled polymer imports are thought to constitute over 20% of polymer consumption in the EU. Plastic waste exports have apparently risen by 36% between 2022 and 2024, highlighting another contributor to the recession: fewer investments in domestic recycling.

Installed plastics recycling capacity was recorded at 12.5 million tonnes in 2022, with heavy market disruptions said to lower the growth rate from 17% to 10%, year-on-year. In 2023, it reached 13.2 million tonnes with a year-on-year increase of only 6% – reportedly its lowest growth since 2017.

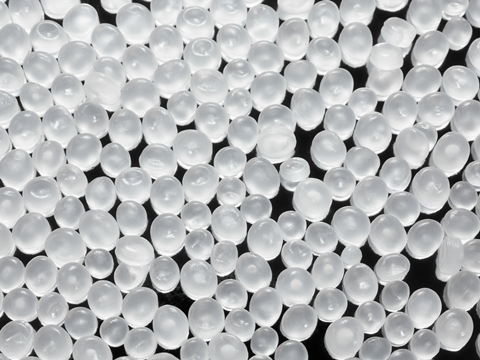

In a new report completed alongside ICIS, Plastics Recyclers Europe states that the EU27+3 region’s high-density polyethylene and polypropylene recycling capacities reached 1.8 million tonnes across an estimated 300 recycling facilities in 2023.

The findings indicate that capacities have stalled again since 2022 – an outcome attributed to competition from imports, high inflation and energy costs, and a global oversupply of polyolefin.

Almost every EU27+3 country is thought to have implemented separate collection for rigid polyolefin waste, yet Plastics Recyclers Europe identifies ‘no notable improvement’ in collection rates between 2018 and 2023.

Collection volumes and recycling input were said to differ due to incompatibilities with design-for-recycling principles, exports, and sorting limitations, among other factors. Only 42% of collected waste was thought to undergo adequate sorting processes in preparation for recycling.

“Key challenges, including insufficient collection, unregulated imports of plastic materials, and a lack of enforcement measures, continue to hinder the expansion of the recycling industry,” explained Herbert Snell, chair of the PRE HDPE Working Group. “The plastic recycling industry calls for urgent actions to alleviate the pressure that the current market situation puts on recyclers and safeguard the achievement of the European legislative targets.”

In order to align with the Packaging and Packaging Waste Regulation’s ‘ambitious’ recycled content targets, the report calculates that the EU27+3 region must achieve 2 million more tonnes of HDPE and PP recycling capacity by 2030, and another 5.7 million tonnes by 2040.

Even so, recycling capacity estimates for 2024 and ongoing market conditions are feared to cause setbacks unless ‘decisive political intervention’ occurs. While the Circular Economy Act and Clean Industrial Deal could contribute to a ‘positive turn’, more immediate measures are thought to be necessary.

Plastics Recyclers Europe concludes that ‘robust’ oversight of imported materials, ‘stringent’ design-for-recycling guidelines, a ‘substantial’ increase in collection rates, and the implementation of advanced sorting technologies are necessary to establish a level playing field and ‘reverse the downward trend’ in EU recycling.

It previously recommended that, in line with Mario Draghi’s report on EU Competitiveness, the EU restrict market entry for imports that fail to align with European environmental requirements. European Institutions were encouraged to “create a genuine circular single market” for plastic waste and recycling.

These measures are set to encourage investment, secure progress, and protect Europe’s recycling industrial base while bringing it closer to its circularity goals.

On a more positive note, Steel for Packaging Europe cites independently verified figures in its assertion that 80.5% of steel packaging placed on the market was ‘really recycled’ in 2022, marking a 2% increase over the 2021 recycling rate. It also revealed in December 2023 that steel packaging had achieved its EU recycling rate target four years ahead of its 2025 deadline.

Additionally, Metal Packaging Europe and European Aluminium report that the overall recycling rate for aluminium beverage cans in the European Union, United Kingdom, Switzerland, Norway and Iceland reached 74.6% in 2022. Even though this marks a 1% drop, it emphasizes that the total amount of aluminium recycled from cans has increased to a ‘record level’ of 580,000 tonnes.

If you liked this story, you might also enjoy:

The ultimate guide to the Packaging and Packaging Waste Regulation in 2025

How are the top brands progressing on packaging sustainability?

Everything you need to know about global packaging sustainability regulation in 2025

The key to increasing the use of reusable packaging in supermarkets

No comments yet