The packaging industry stands at the forefront of a transformative shift, driven by a convergence of trends that are reshaping its landscape. As organizations strive to optimize costs, comply with evolving legislation, and meet sustainability commitments, these trends present both challenges and opportunities. John Blake, Senior Director Analyst at Gartner, tells us more about how the changes can be understood and navigated in order to maintain competitiveness and achieve long-term success.

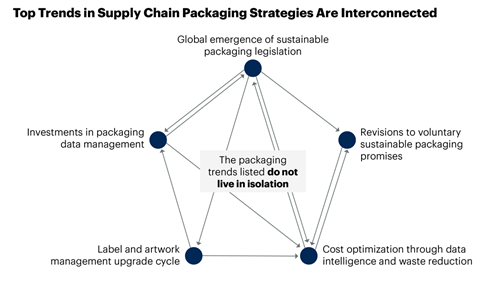

The trends influencing the packaging industry do not exist in isolation. Increasingly, legislation, cost optimization, and data management are becoming interrelated and co-dependent. The U.S. will mark a milestone later in 2025 as the first state, Oregon, implements packaging EPR with Colorado and California expected to follow in 2026 and 2027.

This interconnectedness means that decisions in one area can have significant implications in another. For instance, packaging legislation will impose fees on certain types of packaging, but it also encourages reducing the amount of packaging used. Waste reduction can be a net cost savings.

The legislation also requires more stringent specification data governance for manufactures which can also enable cost savings through harmonization and enhanced purchasing practices. Supply chain leaders are uniquely positioned to observe these connections and influence stakeholders who may be focused on singular aspects.

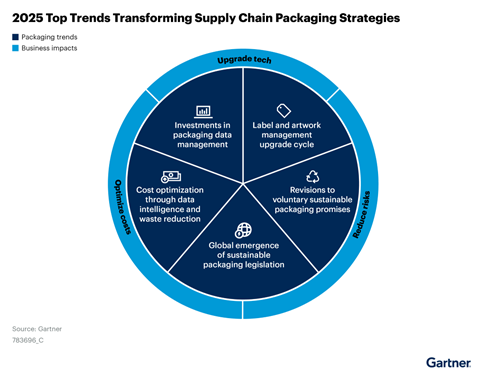

The interconnected trends reshaping packaging

1. Cost Optimization and Waste Reduction

Sustainable packaging initiatives are driving greater transparency in both production and consumption, laying the groundwork for accelerated cost savings through data intelligence and waste reduction strategies.

Nearly 88% of Gartner’s Supply Chain Top 50 for 2024 have established waste-related goals or commitments, highlighting the industry’s focus on addressing resource and operating costs, regulatory requirements, and environmental impacts. However, progress has been challenging, with many enterprises revising their voluntary sustainable packaging commitments.

To effectively reduce waste, enterprises must focus on enhanced design, as up to 80% of a product’s environmental impact is determined during the design phase. This upstream intervention is essential for minimizing waste and optimizing material use and investment. Executive leaders should adopt strategies that align with compliance requirements and sustainability priorities, such as waste and regulatory compliance.

By embracing proactive waste avoidance and resource optimization through upstream innovation, organizations can rethink and redesign products and processes to eliminate waste at its source. Implementing a governance process to ensure new products enhance sustainability and establishing cross-functional teams to identify ongoing waste elimination opportunities are crucial steps in this endeavor.

Through improving data visibility and embracing these strategies, organizations can streamline packaging processes, reduce waste, and achieve significant cost savings, ultimately leading to a more sustainable and efficient packaging industry.

2. Reevaluation of Sustainable Packaging Goals and Impact of Global Legislation

As the target deadline of 2025 is upon them, many organizations are reassessing their sustainable packaging commitments due to technical and financial challenges. This reassessment offers an opportunity to rationalize costs, feasibility and align with evolving sustainable packaging legislation.

By 2028, Gartner now predicts that 75% of organizations with stated sustainable packaging targets will abandon their voluntary goals in favor of aligning to legislative guidelines. This shift underscores the growing influence of sustainable packaging legislation.

Packaging EPR, which assigns producers responsibility for the end-of-life of their packaging, is rapidly expanding beyond Europe to North America, Asia Pacific, and other regions. This policy primarily imposes financial responsibilities on producers, requiring them to pay fees based on the type and amount of packaging sold. Additional requirements may include designing packaging for sustainability, reducing packaging, and reusing packaging, with some jurisdictions imposing restrictions or bans on certain packaging types.

The rise in compliance standards has exposed weaknesses in packaging specification data, which is crucial for meeting reporting requirements. Organizations are turning to packaging EPR compliance software and services to manage the complex nature of global sustainable packaging reporting requirements and mitigate financial risks associated with noncompliance.

3. Advancements in Packaging Data Management

Accurate specification data is essential for packaging legislation compliance. The growth in global sustainability legislation for manufacturers highlights the inadequacies in specification data management solutions, including issues with specification quality, completeness, and accuracy. This has prompted supply chain technology leaders and CIOs to seek solutions to meet compliance requirements.

Many organizations, regardless of region, industry, or size, still rely on outdated or manual processes to manage specification data, leading to resource strains, cost overruns, and risks of noncompliance.

Specification data tools and applications have often been deprioritized and underfunded, resulting in an overreliance on legacy tools, spreadsheets, manual processes, and suppliers to maintain data. These inefficiencies impede organizations’ ability to leverage ML and AI to derive meaningful insights related to product development, optimization, and forecasting regulatory impacts on product portfolios.

To drive support for resourcing specification management upgrades, organizations should leverage the reporting requirements of product and packaging legislation. Informing key stakeholders of the compliance, financial, and brand reputation risks associated with continued reliance on legacy practices is essential. Validating the completeness, accuracy, and quality of specification data with cross-functional peers, such as compliance, risk, finance, and R&D, can be achieved by conducting data evaluations tied to recent packaging legislation.

4. Investment in Label and Artwork Management

Traditionally underfunded, label and artwork management is now receiving increased investment to meet regulatory requirements and accelerate product launches. Applications in this space govern product and packaging content for both physical and digital assets. The digitization of data for label and artwork content supports automation and compliance with data standards, a growing trend in supply chains. This shift offers numerous benefits, including enhanced traceability, reduction in errors, and cost optimization.

Technological advancements, such as the transition to cloud-based solutions that enhance accessibility and the integration of ML and AI, are key drivers of growth in the label and artwork management market. These advancements are particularly influential in manufacturing and life sciences sectors, where complex data management and regulatory compliance are critical.

To drive support for resourcing label and artwork management upgrades, organizations should leverage the data requirements of customers, regulations, and operations. Informing key stakeholders of the compliance, financial, and brand reputation risks associated with continued reliance on legacy tools and practices is essential.

By quantifying which aspects of labeling and artwork change frequently and where there are opportunities to improve speed, cost, and quality, organizations can optimize their label and artwork management strategies effectively.

Towards 2030: Embracing the future of packaging

2025 could mark a watershed moment for the packaging industry. The growth in packaging legislation globally is unprecedented and will likely change how packaging is developed, designed, utilized and recovered post-consumer. Technology, driven by software development, cloud computing, machine learning and AI, will revolutionize the tools used in the packaging industry.

Organizational leaders should consider the leading trends and most importantly their impact when viewed in aggregate. These trends will shape resource and talent needs, investment strategies and mid to long-term packaging strategies.

If you liked this story, you might also enjoy:

Reuse vs. single use – which is better for the environment?

Sustainable Innovation Report 2025: Current trends and future priorities

What can the world learn from South Korea’s world-leading performance in plastics circularity?

No comments yet