In June, we invited packaging consultants Anna Perlina of Integrity Solutions and Renata Daudt from Awen Packaging Consulting to share their insights on how to navigate the EU’s Packaging and Packaging Waste Regulations and how to take action to meet milestones and requirements in a well-attended webinar. This article outlines some of the key takeaways from the event.

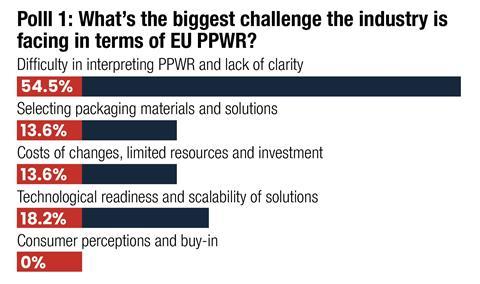

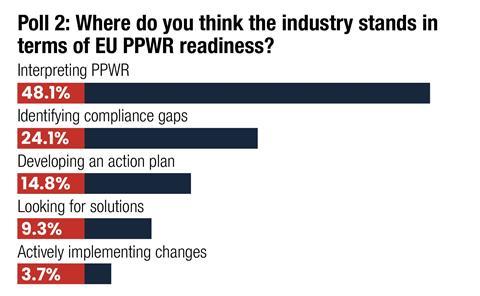

The webinar started with a couple of audience polls. We asked our audience two questions to get a snapshot of where the industry stands with regards to PPWR readiness.

From interpreting legal obligations to implementing packaging changes, the speakers outlined a six-step roadmap designed to help stakeholders across production, distribution, and retail understand, prepare for, and meet the PPWR milestones on time. Anna Perlina started by highlighting the fact that the PPWR sets out minimum requirements for packaging sold across EU markets and that as of now, every packaging strategy and every packaging change in the EU needs to take into considerations the impact of PPWR requirements up to 2040.

“For businesses and the packaging industry in general this means that all packaging strategies and changes should consider the impact of PPWR requirements. A clear vision is needed to not waste time and resources or arrive to the suboptimal outcome.”

Step 1: Interpreting the PPWR according to your context

Renata Daudt reminded us that the PPWR came into force in February 2025, with a transition period until August 2026, at which point it becomes effective. Companies then have until 2030 to align with the regulation, especially around key targets in recyclability and reducing materials. Recyclability thresholds might still be revised depending on evolving technology.

“What is the penalty for not doing anything? You cannot have your packaging on the EU market,” she said.

Businesses need to interpret what this regulation means specifically for their packaging—whether primary, secondary, or tertiary—and align strategies accordingly.

This affects a range of businesses across the value chain, whether they produce packaging, import packaging or distribute packaging. Retailers and hospitality also have to comply or face a penalty.

Daudt emphasized that the regulation’s core objective is not just about recyclability, but reducing packaging waste overall. Plastic packaging receives particular focus due to its environmental impact and recycling challenges. Companies that produce, import, distribute, or retail packaging in the EU will bear responsibility, including data collection and reporting.

Tailored interpretation is key: materials, labelling, sector-specific exemptions, and operational context must be evaluated individually. For instance, reusable options are mandatory in hospitality, while space efficiency in transport packaging is enforced. Failure to act by January 1, 2030 will result in market access being denied.

She highlighted the importance of really knowing your own packaging, as there are no one size fits all rules.

“Think about whether you have primary, secondary or tertiary packaging, understand the materials in your packaging, whether they can be reduced, recycled or reused, and what sort of labelling is required.”

Step 2: Assessing your packaging portfolio

Most businesses are still in early stages of data collection.

“Many don’t even know what types of plastic they use, let alone whether it contains recycled content,” Daudt noted.

Accurate portfolio data is foundational, and presents a checklist to support proper packaging assessment:

-

Start collecting packaging data

-

Is it B2B or B2C packaging?

-

Work closely with your supply chain

-

Focus on products with higher volume

-

Prioritise what the consumer needs

-

Evaluate packaging material types (mono material vs problematic material)

-

Choose the items that are easy to replace

-

Review your packaging range against the RecyClass or CEFLEX standards

-

Evaluate the potential to change design and reduce packaging material

-

Create a hierarchy approach (volume/material type/complexity/design)

She advised prioritizing high-volume products and packaging types with the greatest business impact.

“Start with ‘low-hanging fruit’—non-food applications or mono-material items that are simpler to change. Then gradually tackle more complex designs and sensitive applications.”

Regulatory standards such as RecyClass and CEFLEX should be used to evaluate packaging against recyclability classes. For example, by 2030, only RecyClass Class A and B will be acceptable, and Class C will be phased out, she pointed out.

Step 3: Identifying compliance gaps and opportunities

Daudt introduced a hierarchy approach to help companies prioritize action using weighted criteria—such as volume, recyclability, and design complexity—assigning scores from one to five and summing them to highlight where to start. With this system, a crisp packet, for example, would receive a score of 23, a PET bottle a score of 11, and a milk carton a score of 15.

“You can then allocate teams’ time and resources to higher scoring items to work on high scoring items, which have a higher priority.”

Once assessments are complete, gaps and opportunities become clear. These insights form the foundation of a tailored PPWR action plan.

As Anna Perlina explained, “This is not just a regulatory checklist—it’s about aligning packaging vision with business success.”

Step 4: Building an action plan based on your priorities

Building a plan is based on defining your packaging vision, identifying main risks and opportunities, setting priorities and building a tailored retroactive PPWR timeline. Here it is important to find the common denominator between packaging functionality requirements, PPWR impact, business objectives and restraints and consumer insights and buy ins.

Perlina recommends mapping packaging functionality, sustainability, consumer acceptance, and regulatory targets to create a comprehensive vision and to use a SWOT analysis to audit the current situation. For example, this could look like the following:

-

Strengths: Existing compliant packaging or flexible co-packing capabilities.

-

Weaknesses: Use of composite materials or lack of traceability.

-

Opportunities: Technological advancements or availability of scalable, compliant solutions.

-

Threats: Uncertainty in future recyclability thresholds or fragmented infrastructure across EU states.

Mapping impact versus difficulty of addressing each factor allows teams to focus on high-impact, feasible actions first.

Perlina advised mapping actions and goals on a visual PPWR timeline to spot resource gaps, red flags, and long-lead-time changes. This visibility supports internal alignment and external reporting.

With a vision in place and priorities identified, companies can start shaping a realistic path forward.

Step 5: Finding solutions

“Don’t be tempted by shortcuts,” Perlina warned. “Start broad and map all viable packaging options—regardless of format or material. Then assess functionality, regulatory fit, lifecycle impact, and feasibility.”

As a pathway towards solutions, Perlina talked us through a decision-making flow diagram.

The first step is to identify existing packaging options for your product category, followed by evaluating packaging functional requirements.

“It’s recommended to assess the entire range of packaging options you have, irrespective of packaging material, irrespective of packaging format, irrespective of single use, reuse, et cetera. So just map what’s available out there. The next step we go to assess the functional requirements.”

After that it’s time to assess compliance with EU PPWR requirements and consider life cycle impacts. Next steps are to implement feasibility and viability and make the final choice.

“Here, again it is good practice to map packaging options and give different options scores across functionality, PPWR assessment, LCA impact and feasibility,” she points out.

“People sometimes ask if it makes sense to start with feasibility. This can make sense from a business perspective, but what we want is the proof of assessment that we’ve done so that we didn’t exclude any option and to be open to the best option. This mapping will be a tool to communicate with your stakeholders and with your consumers to explain how you make those choices.”

Step 6: Implementing changes, sourcing certifying

The final step involves implementation and certification. Perlina highlighted several practical tips for this stage:

-

Reduce Complexity First: Streamlining packaging formats and supplier bases can generate savings, freeing up budget to fund regulatory compliance efforts.

-

Create Technical Briefs: Clearly define packaging requirements up front to ensure supplier proposals are comparable and actionable.

-

Leverage Off-the-Shelf Solutions: Existing, commercially available solutions that meet functional and regulatory needs should be prioritized to meet PPWR deadlines efficiently.

-

Consider Outsourcing: Third-party packers may help reduce capital investments and accommodate evolving regulations and market preferences.

-

Secure Post-Consumer Recycled (PCR) Content: With EU-wide PCR content requirements looming, particularly for plastic, companies must start early. The supply of food-grade PCR plastic is limited, so early sourcing and testing are crucial.

-

Get Third-Party Verification: Though self-assessments are accepted, third-party certification provides credibility, supports communication, and can reduce EPR fees.

Implementing packaging changes can take years. Daudt outlined a general timeline: Allow one month to interpret the regulation, one to three months for packaging assessment, one to three months to define gaps and opportunities, three to six months to develop a tailored action plan, three to six months to find and validate solutions, and up to two years for implementation.

Cumulatively, full compliance can take up to four years. “2030 might seem far, but the clock is ticking. Act now,” Daudt stressed in conclusion.

Anna Perlina and Renata Daudt are content partners of Packaging Europe’s Sustainable Packaging Summit, which this year will take place in Utrecht in the Netherlands from November 10th to 12th. Join them alongside other leaders from across the value chain to share solutions, insights, and innovations as the industry moves towards a more sustainable future.

No comments yet