The influence of bioplastics keeps growing in the packaging market and this year Packaging Europe will again be reporting from the annual European Bioplastics Conference in Berlin. Ahead of the forum Katrin Schwede, head of communications at European Bioplastics, spoke to Tim Sykes about the key trends and challenges in the market.

Tim Sykes:

The European Bioplastics Conference has become the reference point for the industry calendar. Could you please describe the aims of the event and the role it plays in the world of bioplastics?

Katrin Schwede:

In keeping with this year’s theme ‘Making the Difference’, the 12th edition of the annual European Bioplastics Conference will showcase just how bioplastics influence the plastics industry in driving innovations forward for more sustainability, resource efficiency, and functionality. Today there is a bioplastic alternative to almost every conventional plastic material and corresponding application. While offering the same qualities and functionalities as their conventional counterparts, bioplastics strive to be even better by providing innovative solutions with improved properties as well as the unique ability to reduce emissions and our dependency on fossil resources.

The European Bioplastics Conference has evolved into the leading business and discussion forum for the bioplastics sector in Europe and worldwide. It has been both witness and supporter of some of the biggest achievements of the industry and it brings together all stakeholders along the entire value chain to shape the future of bioplastics. The impressive speaker line-up and diversity of the conference delegation – 350 strong in 2016 and expected to grow – reflects that. The two-day event will demonstrate how far bioplastics have come and highlight some of the latest and most innovative developments in new bio-based materials and applications.

TS:

May we have a glimpse of some of the highlights of this year’s conference?

KS:

Every year, the European Bioplastics Conference features a well-rounded conference programme attracting senior executives from across the bioplastics value chain, policy bodies, NGOs, and brand owners. The agenda of the 12th European Bioplastics Conference will cover a wide range of important areas, including the EU policy landscape, the latest technological innovations in new building-blocks, alternative bio-based feedstocks and process routes, advances in end-of-life solutions outside industrial composting, bioplastics food packaging, as well as the brand perspective on the use of biopolymers. And in keeping with a well-received tradition, European Bioplastics will publish the latest bioplastics market data update during the conference.

Some of the highlights of this year’s programme include Kevin Vyse from Marks and Spencer, speaking about the sustainable use of biopolymer packaging, Marie Hélène Gramatikoff from Lactips, sharing insights about biobased thermoplastics from milk protein, and Ramani Narayan (Michigan University) assessing whether mealworms and caterpillars are the new solution to the plastic waste problem. Besides a session on the latest R&D on marine biodegradability, one particular highlight will be a session dedicated to new building blocks featuring Synvina, Covestro, and VTT Chemical. Another highlight will be a panel discussion on the mechanical recycling of bioplastics that will explore the options for biopolymers such as bio-based PE and PLA, which no doubt will be of great interest for all delegates. Panellists include Karin Molenveld (Wageningen Food & Biobased Research), Steve Dejonghe (Looplife Polymers), Helmut Schmitz (Grüner Punkt), and Jasmin Bauer (Knoten Weimar).

The conference programme will be complemented by a number of networking opportunities, such as social evenings, interactive conference formats, exclusive networking areas and a digital partnering tool, and a comprehensive product exhibition alongside the conference. Following the great success of the past years, we again expect another exciting, informative, and fruitful conference in 2017.

TS:

Speaking about European Bioplastics as an organisation, what has the focus of your activities been this year?

KS:

This is a critical time for our industry as the European Union confirmed its commitment to the transition from a linear to a circular economy in Europe and the assessment of the plastics economy. European Bioplastics has been involved in the consultations to help shape a policy and economical landscape for our industry to strive in. European Bioplastics has been an active partner in the debates around the Packaging and Packaging Waste Directive and the Waste Target Review, which brought about the decision by the Plenum of the European Parliament to increase the use of bio-based plastics in packaging, to enforce a separate biowaste collection, and to include organic recycling in the definition of recycling. Moreover, the European Parliament’s IMCO Committee supported the use of biodegradable mulch films in a report on the revision of the EU Fertilisers Regulation, which we follow very closely in the debates leading up to the final vote in the Parliament.

As the leading industry association, European Bioplastics is also committed to raising awareness and educating consumers about the nature of bioplastics. This summer, we’ve launched a campaign to increase the knowledge about bioplastics and to clear up some of the most common misconceptions. For this purpose, we’ve developed a series of infographics that we rolled out on social media and plan to produce a number of shorter video clips to help share the potentials and benefits of bioplastics. We are very excited about this since the reactions so far have all been very positive.

TS:

How do you see the present regulatory climate in relation to bioplastics? Do the Circular Economy package and the EU roadmap for plastics strategy support the further growth of the industry? Is there anything these formulations could improve upon?

KS:

The European Commission’s commitment to the transition from a linear to a circular economy model in Europe has certainly accelerated the momentum of growth and development of the bioplastics industry in Europe. Bioplastics will play a key role in this transition by replacing fossil with renewable resources and by increasing recycling targets and waste management efficiency. We also welcome the priority the Commission has given in the EU Roadmap for a Plastics Strategy to assess how to decarbonize the plastics economy and to increase efficiency of plastics recycling, and we hope that this will remain a main pillar of the upcoming Strategy on Plastics in order to address some of the most pressing challenges of our time, namely climate change and resource efficiency.

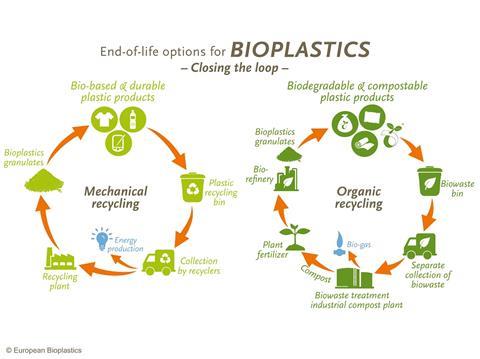

One important point missing in the roadmap, however, is the need to consider recycling as both organic and mechanic recycling. Only if the separate collection of bio-waste and organic recycling is encouraged can the quality of other waste streams and the overall efficiency of waste management be increased. Organic recycling (industrial composting and anaerobic digestion) is a well-established industrial process ensuring the circular use for biodegradable plastics while creating a strong secondary raw material market and opportunity for renewable energy generation. The greater part of bio-based plastics can easily be recycled in existing recycling streams. This way, bioplastics contribute to keeping carbon and valuable resources in the loop.

TS:

How is the market for bioplastics in packaging growing?

KS:

Over the past ten years, the bioplastics industry has flourished and developed into a fast-growing innovative sector. We recently witnessed a growing number of major brands switching from fossil-based to bio-based materials or to offer biodegradable solutions for their products or packaging. They respond to the increased consumer demand for more sustainable products and an overall change in awareness about the impacts of consumption choices on the environment. There is a growing demand for packaging made from bioplastics. This trend was confirmed by this year’s interpack – the world’s biggest packaging trade fair – which was dominated by three major themes: innovation, resource efficiency and sustainability. Besides the 30 bioplastics companies presenting their innovative materials, many other – if not most – traditional packaging companies at the trade fair also offered bio-based or biodegradable alternatives or options additional to their conventional packaging solutions. This clearly shows that bioplastic packaging is not a “nice to have” but highly demanded by clients, brands, retailers and customers alike. Packaging is and will remain the strongest market segment for bioplastics, with currently around 40 per cent (1.6 million tonnes) of the global bioplastics production capacities being used in packaging. This share is predicted to increase even more to up to 44 per cent (2.5 million tonnes) in 2021.

TS:

What challenges do supply/demand factors, such as fluctuating fuel prices, increasing capacities, demand for renewable feedstocks from other sectors, and increasing volumes of recycled feedstocks, create for the industry?

KS:

As more companies and brands are switching to bio-based plastics, and as production capacities are rising, supply chains and processes are becoming more efficient, and prices have come down significantly. Even though the currently low oil prices are making it difficult for bioplastics to achieve competitive pricing levels compared to conventional plastics at present, we are confident that this is not a long-term trend and that the bioplastics industry will continue to grow given the positive signals from Brussels to support the bio-based economy in Europe.

TS:

Are there any areas of technological progress which are accelerating the uptake of bioplastics in packaging?

KS:

Biodegradable and compostable packaging solutions are particularly sought after in food packaging because they offer a new route for recycling. When the packaging is mixed with perished food or biowaste, mechanical recycling is not feasible for the plastic material. The use of compostable plastic packaging makes the mixed waste suitable for organic recycling and enables the shift from recovery (incineration) to recycling and increases the volumes of valuable compost. Materials such as PLA, PHA, PBAT, PBS and starch blends are particularly suitable for food packaging. PLA is a major growth driver in the field of bio-based and biodegradable plastics. It has excellent barrier properties and is very versatile. Some companies also offer high-performance PLA grades that can withstand high temperatures. PHA is another important polymer family that has been in development for a while and has now finally entered the market at commercial scale. PHA polyesters are 100 per cent bio-based and feature a wide array of physical and mechanical properties, including improved barrier properties suitable for food packaging. PHA is biodegradable and compostable in industrial composting plants but also in other environments such as marine waters. Another new exciting material is PEF (polyethylene furanoate), a new polymer that is expected to enter the market in 2020. PEF is comparable to PET but 100 per cent bio-based and it features superior barrier and thermal properties, making it ideal material for the packaging of drinks, food and non-food products. Currently, PEF is still at the development stage, but with more players getting involved, the future for this new material is looking very optimistic.

Some of these latest developments will also be presented at the 12th European Bioplastics Conference. The Fraunhofer Institute for Silicate Research ISC will present new functional coatings for biodegradable packaging which have excellent barrier properties against water vapor, oxygen and flavours and are proven to be suitable for foodstuffs, especially in the convenience sector. The University of Queensland will also present the latest developments in the field of biodegradable multilayer packaging. The Australian research team develops stratified materials of thermoplastic strength (TPS) and PHA for use in food packaging with high barrier properties. Investigations on the life cycle assessment of the material promise excellent values in the reduction of greenhouse gas emissions.

TS:

How does the industry articulate the environmental case for bioplastic packaging to brand owners and consumers as superior to alternative packaging materials? Do you need to address concerns that feedstocks may be diverted away from food applications? How does the overall carbon footprint of bioplastics compare with competing materials?

KS:

More and more companies are looking for innovative ways to meet the ever-increasing demand for sustainable plastic products and packaging without compromising on the quality and profitability of their products. Bio-based plastic packaging, for example, offers the same functionalities and technical characteristics as conventional plastic packaging but additionally has the unique ability to reduce greenhouse gas emissions and our dependency on fossil resources. At the same time, the bioplastics industry has invested heavily in the development of new, innovative materials with improved properties and higher functionality. This allows companies to not only improve their products and resource efficiency but also their environmental footprint. Substituting fossil-based plastics by bio-based plastics generally leads to a reduction of greenhouse gas emissions and the use of fossil resources.

Some companies interested in switching to bioplastics raise questions and potential concerns about the use of plant-based feedstocks and food crops for the production of bioplastics. These concerns are unfounded. The land needed to grow the feedstock for today’s bioplastics production is around 0.02 per cent of the global agricultural area. A recent report by Wageningen UR finds that ‘even if we base all present world-wide fossil plastics production on biomass as feedstock instead, the demand for feedstock would be in the order of five per cent of the total amount of biomass produced and harvested each year by mankind’. This estimation does not include the expected increased use of waste feedstocks as well as the development and improvement of agricultural practices for higher yields. The use of bio-based feedstocks for the production of bioplastics is by no means a competition for the production of food or feed.

TS:

How do you envisage the industry developing over the next five years?

KS:

I have no doubt that the industry will continue to grow driven by the increasing demand for sustainable products due to a growing awareness of society’s impact on the environment as well as the continuous advancements and innovations in new materials and applications for bioplastics in packaging and beyond. One key area we will most likely see a lot of development in is a greater diversification of feedstocks used for the production of bioplastics. There are already quite a few companies and research organisations working with second and third generations of renewable feedstock. Especially biowaste will be a very interesting feedstock of the future. On-going research projects include creating bioplastics materials form coconut fibre, nut shells, tomato peel, crab shells, algae, and even cow dung. Moreover, NatureWorks just recently opened a research lab in Minnesota to develop and commercialise the fermentation process for transforming the greenhouse gas methane into lactic acid, the building block for PLA, one of the fastest growing bioplastics materials. The sky is the limit.